Khor Reports: RSPO data’s points to supply growth and lackluster demand

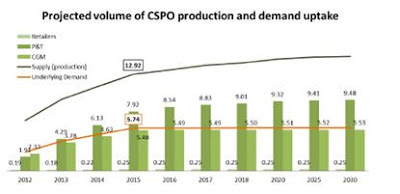

Back in 2010, Khor Reports first highlighted the problem of a structural demand deficit at the RSPO. The latest supply and demand forecast from the voluntary sustainability certification organisation suggests that supply is set to continue exceeding demand by a factor of two for the foreseeable future ie. market uptake for CSPO may remain at about 50 percent, even during the 2015-2030 period.

RSPO publishes key data from its members for the first time

The RSPO requires that its members report on both their progress and their future commitments on sustainability. In its “Annual Communications of Progress” (ACOP) effort for 2011/12, the RSPO has made a good effort to offer crucial insights into the future supply and demand for its sustainability program. For the growers, this means they need to report annually on key items such as planted area, new planting area, and third party fresh fruit bunch (FFB) sourcing. For consumer goods manufacturers (CGMs) and retailers, they need to report on volume of palm oil products sold in own-brand products. Crucially, all have to report on their time-bound plan (TBP) or year to achieve their respective 100% implementation of RSPO certification.

Future market uptake of CSPO may range 40-62%

By the RSPO’s reckoning, market uptake may only be 44% in 2015, subsequently drifting down to 39% in 2020 and 38% in 2030. This forecast is based on a relatively conservative “underlying demand” which comprises commitments based on current usage by CGMs (includes key users of palm oil such as Unilever and Nestle as well as big bio-diesel providers such as Neste Oil) and retailers (including the likes of Wal-mart and Tesco, with significant own-brand products businesses). For fear of double-counting, this demand forecast excludes volumes from the processors and traders category (whose members include Wilmar and Cargill), since they are supply-chain providers to the aforementioned groups and no detailed information was sought on volumes for their own end-product usage, which includes cooking oil and animal feed.

Source: RSPO

On a more optimistic measure, based on commitments by processors & traders, demand could rise to 7.92, 9.32 and 9.48 million MT in 2015, 2020 and 2030; resulting in market uptake of about 62% for 2015 through 2030.

Taking the average of the more conservative and more optimistic demand forecasts, the outlook is for 51% market uptake for the period 2015 to 2030. Thus, the RSPO concludes in its October 2012 report that “the current pattern of only about half of available CSPO being consumed may persist unless more manufacturer and retailer members of the RSPO make commitments to use it on the supply-side…. the RSPO needs to work harder to increase the number of CGMs, including as yet non-members who are committing to use CSPO as well as far harder at promoting CSPO amongst companies that are not yet members. In particular, markets outside of Europe and the US need to start demanding CSPO if the projected supply is going to be matched by demand.”

Structural oversupply

This lacklustre outlook is despite the good effort of RSPO in rapidly expanding members in the CGM and retailer categories in the last two years and pushing for 100 percent global procurements from them by 2015. The effort of the WWF's buyers’ scorecard (to pressure CGMs) has been quite instrumental in this regard too. RSPO is the brainchild of the WWF.

The forecasted demand deficit therefore appears to be a structural problem. We think it is a result of two factors.

First, the highly concentrated industry structure in the global palm oil growing sector clearly exceeds that of the global CGM industry. Unilever, with 1.3 million MT of palm oil usage each year, has played a key lead role in the RSPO. Subsequently RSPO has signed on many others. It is hard to think of a big global brand who is not a member. However, the commitments from nearly all the big global brands are insufficient to mop up supply of RSPO sustainable certificates from the growers. This sector is highly concentrated with 85 percent global supply from Indonesia and Malaysia where very large corporate growers have a big market share. In Indonesia alone, there are five (5) groups whose individual annual production of palm oil are close to or significantly exceed Unilever’s tonnage. Big growers are key contributors to the RSPO. Small estates and smallholders have been left out of the certification game (apparently unless receiving exceptionable financial and/or non-financial support).

Second, the RSPO requires 100 percent of a grower’s area to be certified. It is therefore designed to disregard market demand. This is in contrast to the Roundtable on Sustainable Soy (RTRS), the certification for soy, the key competitor of palm oil. Here, the WWF and Unilever also play key roles. RTRS members, while having to abide by some key universal principles, are free to decide how much of their area should be certified.

The RSPO therefore faces the challenge of boosting demand for sustainable palm oil, beyond the global brand names and in the face of "palm oil free" challenges in its key EU market.