Krugman on need for growth

Last Wednesday, I managed to get a spot at a talk of deflation risk by Paul Krugman. Skidelsky (Keynes biographer) was on the panel. The talk was led by Sanjaya Lall Foundation and Malaysia's Khazanah sovereign wealth fund had a presence. Maybe they paid for the cocktails after. I didn't have time to get enough of those smoked salmon blinis.

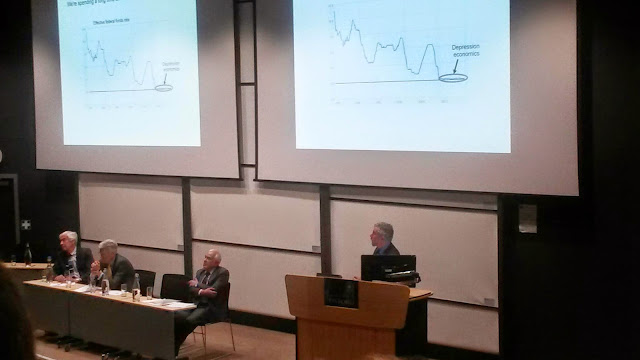

Krugman talked about problem of demographic and real estate drags (-4 pctage points pa on the latter) on economic growth. He seems to be painting Japan post 1980s scenario for US and perhaps more so Europe. On US data he showed how each recession needed ever lower interest rates to boost growth again (see photo), but with the previous two post recessions booms feeding into the Internet and housing bubbles. Krugman was very confident that economics knows what to do get us out of the current morass. One should be unconventional and aggressive with deep negative interest rates to force people not to save and thus boost aggregate demand (AD) for employment and growth. But he was disappointed that the politicians have not taken up this obviously low cost policy option. The dismal conclusion seemed to be that politicians and others would be too conventional and not use this simple cheap solution.

His 24 October 2013 op-ed is a good summary of his point against those who don't get it : "They just assume that it would cause soaring interest rates and economic collapse, whenboth theory and evidence suggest otherwise. Don’t believe me? Look at Japan, a country that, like America, has its own currency and borrows in that currency, and has much higher debt relative to G.D.P. than we do. Since taking office, Prime Minister Shinzo Abe has, in effect, engineered exactly the kind of loss of confidence the debt worriers fear — that is, he has persuaded investors that deflation is over and inflation lies ahead, which reduces the attractiveness of Japanese bonds. And the effects on the Japanese economy have been entirely positive! Interest rates are still low, because people expect the Bank of Japan (the equivalent of our Federal Reserve) to keep them low; the yen has fallen, which is a good thing, because it make Japanese exports more competitive. And Japanese economic growth has actually accelerated...."

The panel and Q&A did not bring strong challenge to this view. It was developed country centric. On a question on climate change, Krugman saw environmental stresses as another business opportunity to push AD. I suppose this is happening as standards imposed in developed economies and on developing nations via trade standards is growing a new sub sector of activity. But there is the argument that all this is not really changing the outlook for the environment but merely helping us more efficiently destroy the environment.

I chatted with several people about Krugman's policy views. Most talked about inequality, housing and asset bubbles. My demography professor remarked on bigger negative rates: but what would happen to aged pensioners?

An Asian businessman said:

My concern with Krugman's prescriptions is that the world effectively goes into competitive devaluations. Imagine every major economy doing likewise. Some say that Japan needs to create excess liquidity of US$9 trillion to deflate away the fiscal debts. That's 3 times US QE. And now Euro zone talking of the same. Surely, China will deflate too to protect exports. Then what? Yes, aggregate demand grows. But surely we fall right back into hyper inflation? The excess reserves are not yet translated into money supply. That will happen the moment agg demand expands.

Expand the pool of money even more? I don't believe in a free ride. Printing money does not sound right. Maybe I am too traditionalist. Frankly, the world has enough wealth. It has enough production. It needs to balance disparity. And it's not all that bad to allow nature a rest, from excessive exploitation. If we have enough housing stock and with less population, why keep building? We should not grow for the sake of growth. The fear of deflation is real as in Japan and maybe elsewhere. Japan was in stagflation the last 2 decades but the world grew... China, the rest of Asia etc. Europe may go into stagflation due to its population profile but Africa will grow. I think the agendas are different. It's about western growth by exporting on devalued currencies.

Bottom line: Krugman says we are in unprecedented depression economics. But others ask if we are too addicted to growth and bubble cycle and beggar thy neighbour policies?