Brazil's Vale in Malaysia (update 1b): Distribution in 10 days and 35% reduction in carbon emissions per tonne of ore

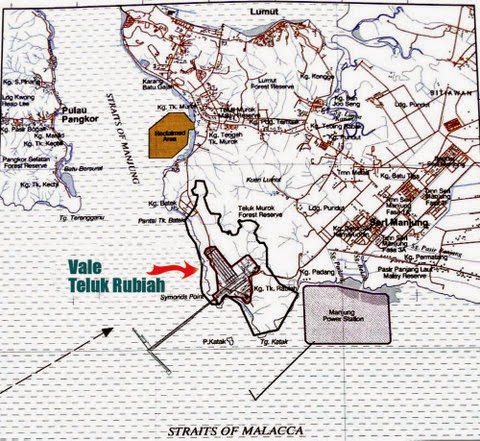

This is interesting. Vale spends US$1.4 billion in Lumut to build its new Asia port terminal at Teluk Rubiah, Perak in the Straights of Malacca. Valemax 400,000 tonne vessels are just huge! We had neighbours who are engineers from Brazil to help implement this project. Progesys notes that "the stockyard is designed to be able to handle 30m tons of iron ore annually and can be expanded to take a maximum capacity of 60m tons per annum."

Is this akin to what's happening in palm oil merchandising? The likes of Wilmar and Musim Mas have taken strategies to have terminals / bulking / capacity / logistics in key end use regions such as Africa (Wilmar noted to have bought / built / booked up capacities to better serve Africa buyers) and Europe (Musim's biodiesel acquisitions). From key industry sources, it is notable to hear Malaysia earlier had an allocated budget to help build up joint terminal / bulking facilities in strategic locations, but this never got off the ground on apparent commercial disinterest or dissension. Malaysia palm oil is facing stiff competition from Indonesia palm oil. On the latter's upstream expansion, it is inevitable that it gains market share.

Is this akin to what's happening in palm oil merchandising? The likes of Wilmar and Musim Mas have taken strategies to have terminals / bulking / capacity / logistics in key end use regions such as Africa (Wilmar noted to have bought / built / booked up capacities to better serve Africa buyers) and Europe (Musim's biodiesel acquisitions). From key industry sources, it is notable to hear Malaysia earlier had an allocated budget to help build up joint terminal / bulking facilities in strategic locations, but this never got off the ground on apparent commercial disinterest or dissension. Malaysia palm oil is facing stiff competition from Indonesia palm oil. On the latter's upstream expansion, it is inevitable that it gains market share.

16 November 2014: Vale 10 days distribution with major GHG savings, Vale surprise loss, LMT's exclusivity concession compromised

New Strategically Located Deep Water Bulk Ore Handling Terminal and Distribution Hub Opens -

Thirty Million Tonnes per Year Capacity Available for Iron Shipments; 12 November 2014; "The new facility is a point where the ore can be stored and blended. Located in the Straits of Malacca, distribution of the ore will take a mere ten days, as opposed to the 45 day trip from Brazil allowing a much reduced delivery time for the iron ore to Vale’s clients in Asia and Southeast Asia. Murilo Ferreira, Vale's Chief Executive Officer, said: "Teluk Rubiah is a cornerstone of Vale's business strategy of investing in solutions which aim to enhance the company's capability to supply iron ore more efficiently to the Asian markets. The distribution centre brings our mines closer to our customers in Asia." .. With Teluk Rubiah, Vale will have the opportunity to blend ores with different grades from its production systems, which were always sold on the market separately, each one with different specific features, providing greater flexibility for supplying iron ore. Furthermore, the distribution centre, combined with a fleet of very large ore carriers, represents a more sustainable solution, contributing to a reduction in greenhouse gas emissions for iron ore delivered in Asia. Teluk Rubiah is capable of receiving the somewhat conceitedly named Valemax vessels, which allow for a 35% reduction in carbon emissions per tonne of ore transported. From there, the iron ore is transported in Capesize vessels to its port destinations...." http://www.handyshippingguide.com/shipping-news/new-strategically-located-deep-water-bulk-ore-handling-terminal-and-distribution-hub-opens-_5953

Vale Posts Surprise Loss as Currency Compounds Iron Rout By Juan Pablo Spinetto October 30, 2014; "Vale SA (VALE5), the world’s largest iron-ore producer, posted a surprise loss after a weaker Brazilian real boosted dollar-denominated debt and falling commodities prices pushed down sales to the lowest since 2010. Vale swung to a net loss of $1.44 billion, or 28 cents a share, in the third quarter from a profit of $3.5 billion, or 68 cents a share, a year earlier, it said today in a statement. The average of nine analyst estimates compiled by Bloomberg was for profit of 32 cents a share, excluding some items. Shares fell the most in Brazil’s benchmark index today... Iron-ore prices have fallen by more than half since a 2011 peak as Vale, Rio Tinto Group and BHP Billiton Ltd., the three largest producers of the steelmaking raw material, boost supply to gain customers. Results were impacted by $2.68 billion in foreign exchange and monetary losses on debt and derivatives...."

http://www.businessweek.com/news/2014-10-30/vale-posts-surprise-quarterly-loss-on-weaker-real

RAM Ratings reaffirms Lumut Maritime Terminal’s notes Thursday, 13 November 2014

KUALA LUMPUR: RAM Rating Services Bhd has reaffirmed the A1/Stable rating of Lumut Maritime Terminal Sdn Bhd’s (LMT) RM60mil Bai’ Bithaman Ajil Islamic debt securities (2004/2017) (BaIDS). It said on Thursday the rating remains anchored by the continued steady cashflow from LMT’s operations and maintenance agreement with Lekir Bulk Terminal Sdn Bhd (LBT), which at present caters to the coal-unloading requirements of TNB Janamanjung Sdn Bhd.

“The company’s rating is moderated by the dependence of its small port operations primarily on hinterland cargo, keeping a lid on growth potential. “Meanwhile, revenues from the sale of land in the Lumut Port Industrial Park – which LMT has developed – are expected to taper, given limited land left to be sold, which will somewhat reduce its income diversity,” said the ratings agency. Perak Corporation Bhd, which is listed on the Main Board of Bursa Malaysia, holds a 50% stake plus one share in LMT.... LMT has a 20-year concession agreement (CA) with the Perak Government where it has exclusive port operations within a 30-km radius. However, the agreement ends in July 2015. “It remains to be seen whether the CA will be extended beyond next year, and we note that LMT’s exclusivity had been compromised in 2011 following the State Government’s approval of the establishment of a private jetty in Teluk Rubiah by Vale International SA,” it added.

http://www.thestar.com.my/Business/Business-News/2014/11/13/RAM-Ratings-reaffirms-Lumut-Maritime-Terminal-notes/?style=biz

10 November 2014

Brazilian giant seeks to erode its geographic disadvantage in supplying Australian customers as falling iron ore prices hurt producers' margins; UPDATED : Saturday, 08 November, 2014, 5:43am by Bloomberg in Singapore and Rio de Janeiro; "Vale inaugurated a US$1.4 billion port terminal in Malaysia as the world's biggest iron ore producer seeks to cut costs of shipping to Asia from Brazil with prices at five-year lows.... The facility on the Malacca Strait to stock and blend supplies would help Rio de Janeiro-based Vale compete against BHP Billiton and Rio Tinto Group in Australia, said Paul Gait, an analyst at Sanford C Bernstein.... Up to last month, eight Valemax vessels - the biggest ore carriers that can haul as much as 400,000 tonnes - had already called at the Teluk Rubiah site to discharge cargoes, with five smaller Capesizes loaded, Vale said.... "Vale is significantly farther away from the main centres of demand than its Australia competitors," Gait said. "What Vale can do is to lower the apparent cost of logistics, shrink the world, if you will, and make distance not matter so much."... Iron ore tumbled 44 per cent this year as increased supplies from Vale, BHP and Rio created a glut, prompting producers to squeeze costs to preserve margins...."

http://www.scmp.com/business/

source: Teluk Rubiah: Vale of Tears for the “Malaysia Project” By Mariam Mokhtar

March 1, 2012; http://www.ipohecho.com.my/v2/2012/03/01/teluk-rubiah-vale-of-tears-for-the-malaysia-project/

March 1, 2012; http://www.ipohecho.com.my/v2/2012/03/01/teluk-rubiah-vale-of-tears-for-the-malaysia-project/

About Valemax vessels:

http://www.vale.com/EN/aboutvale/initiatives/valemax/pages/default.aspx

China's ban on Valemax:

http://online.wsj.com/articles/SB10001424127887324595904578116702590372508 ;

http://www.lloydslist.com/ll/sector/dry-cargo/article424134.ece

About Port Abbott, Northern Queensland:

http://www.portstrategy.com/news101/port-operations/cargo-handling/ore-struck