Recent protocols allow frozen whole durians to be exported to China, home to the fanatics of the King of Fruit. In the past, only frozen durian pulp and purée were imported. Trade regulations are strict.

With a surge in interest for Malaysia's famed stinky fruit, suppliers of durian in Malaysia are responding to the spike in durian prices with production and processing for export related activities. For example, durian tourism (orchard tours and farm stays, with some all-you-can eat options) has been on the rise; catering to Chinese tourists in Pahang, and particularly in Bentong. Additionally, small-time investors are tempted to purchase land in durian orchards or plantations, with fractional ownership in small plots and even individual trees on offer.

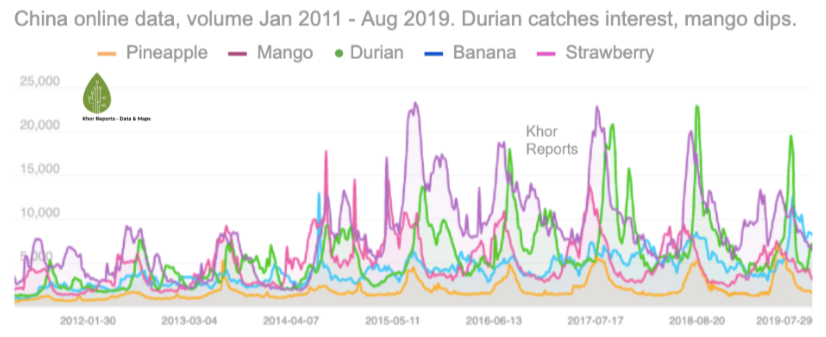

Khor Reports has consolidated data on fruit farms across Malaysia, durian key indicators for Malaysia (supply chain, prices and more), and the durian economy in China. This is available on a dashboard and maps. The sources include information from official data, news reports, trade data, and e-commerce platforms. This presents a holistic view of the status for Malaysian durian farmscape, products and China retail indicators. Data is as of 30 August 2019.

Note: Other details available for ‘Fruit Farms in Malaysia’ include types of other fruits, category types, e.g. Alibaba, MyGAP, and land addresses. We have approximately 3,300 rows and 80 columns of data.

With China offering a pathway for compliant whole fruit, it is predicted that China will import USD 120 million a year from Malaysia. According to official data, premium-grade exports was nearly 75,000 tonnes in 2018, with approximately 23 percent exported to China. This is very small compared to Thailand exports which have long dominated the durian trade to China. But public interest and Chinese consumers are caught UP by the fully tree-ripened durians that Malaysia offers; with the prized Musang King being one of the prime examples. This is in contrast to the typical (blander) durians from Thailand that ripen during transit.

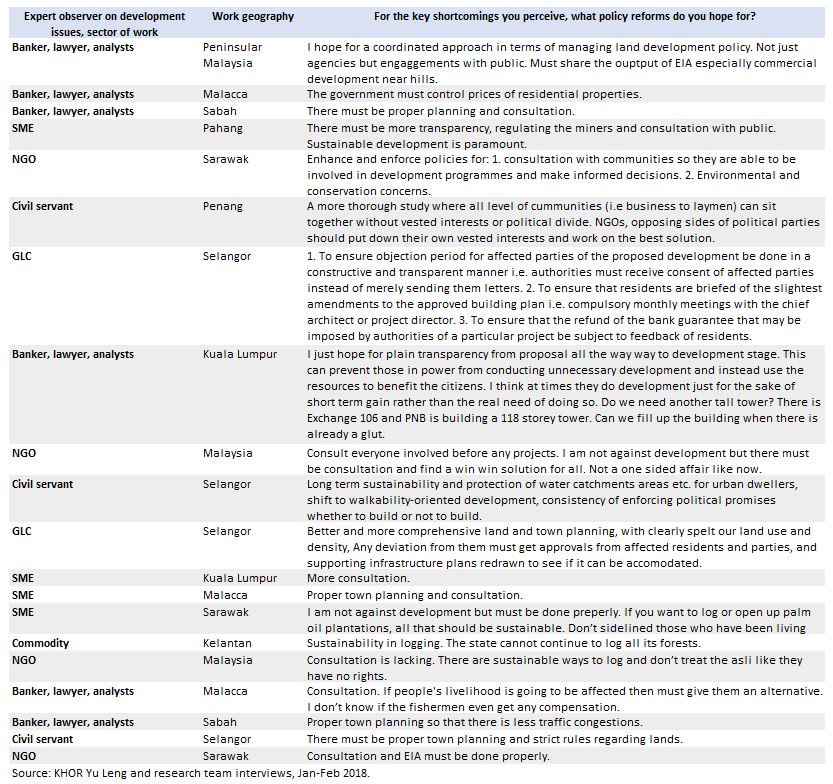

In order to meet the growing demand for durians, existing planted areas are being converted but there is concern that forests may be destroyed. There have been several reports on this: and its negative impacts on the rights of native people and on biodiversity. A news article recently reported the deforestation of 1,213 hectares in Hulu Sempan (Pahang) for durian plantations, putting the likes of Malayan tigers at further risk of extinction. Furthermore, there are reports of Temiar villages in Gua Musang (Kelantan) still tussling for their rights to their ancestral land.

While Malaysian growers are benefitting from the increased trade in the fruit, it is important to acknowledge the trade offs that will affect the Malaysian people and the environment. Deforestation is a thorny issues and so is uncertainty on future pricing of durians. There is a need for a multi-stakeholder review on how we can best ensure sustainability of the durian agri-value chain.

More details are available on a customised basis; including additional data fields. Please contact us to find out more.

Maps and datasets were assisted by Nadirah Sharif and Loh Rachel of Khor Reports.

#Durian #MusangKing #China #Malaysia #ChinaMalaysia

(c) Khor Reports - Segi Enam Advisors Pte Ltd. 2019. All rights reserved.