I have been reviewing some general stats for a #HighSpeedRail project comparison. RM1-trillion-in-debt (US$250 million) Malaysia is relooking its KL-Singapore HSR project (#MyHSR #SgHSR), and I take a look at the Taipei-Kaohsiung HSR which has intriguing similarities including the price tag.

Commentary in Channel News Asia published on 2 July 2018, available here.

Rapid transit is looking into novel systems. In recent news #ElonMusk's 2013 novel tube-transit #HyperLoop idea is getting a serious look by Chicago (albeit a more basic #Loop non-vacuum or conventional tunnel version)! Notably, no taxpayer money (nor hidden guarantees, presumably). It is private funded. "In exchange for paying to build the new transit system, #BoringCo would keep the revenue from the system’s transit fees and any money generated by advertisements, branding and in-vehicle sales." Chicago set transit time and ticket cost hurdles, and got four bidders.

Back to conventional HSR. In summary, Malaysia cost concerns include:

· A lower project cost. In consideration of the high debt situation, and to lower fares.

· A lower fare, to undercut the cost of air travel between Singapore and KL.

· A lower fare, for an affordable domestic service for the average Malaysian.

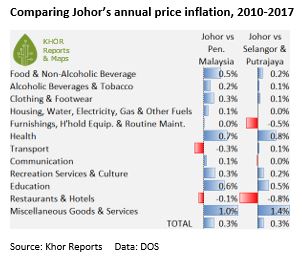

There will no doubt be a wider discussion on the #socioeconomic implications of HSR and lower-cost medium-speed rail options now mooted (at 1/3 the cost of KL-Singapore HSR) . The #Mahathir administration is mandated to improve the livelihoods of the average Malaysian and look into issues of jobs, incomes, affordability of homes, and the cost of living. Sources reckon that part of the KL-Singapore HSR justification is property development and a ramp up in property prices. If this is so, it may not sit well with ongoing concerns about affordability.

Please contact us for detailed data and analysis; and for redistribution.

(c) 2018 Khor Reports - Segi Enam Advisors. All rights reserved.