Khor Reports' Talking Series

TALKING Malaysia renewable energy

11 Nov 2019

Q&A with Ir. Krishna Moorthy P., P.Eng., MECC Engineering Sdn Bhd.

With a data-info addendum by Khor Reports

(11 Nov 2019) Edit : Calculations in the footnote (5) has been edited for the announcement in October 2019; the relevant news article link has been added into the data-info addendum. It states “Malaysia’s transition into a higher RE mix by 2025 is estimated to contribute to over 100,000 in employment opportunities, of which 39% will be in mini hydro, biomass (28%) and biogas (11%). Rooftop solar and large scale solar will make up about 22% of the projected employment figure.”

Q. What has shifted in Malaysia's Renewable Energy (RE) policy under the new Pakatan Harapan administration?

The previous Barisan Nasional (BN) government’s “National RE Policy and Action Plan” attempted to increase renewable energy (RE) through electricity generation using biomass, biogas, small hydro and municipal solid waste or MSW to its maximum potential of 16,000 GWh per annum. That is, approximately 11% RE in the energy mix of electricity supply sector by the year 2028 and thereafter continue with the ramp up of solar-PV (photovoltaic). There are many good reasons for this approach, that does not over emphasise solar-PV.

In contrast, the Pakatan Harapan (PH) administration’s RE policy appears to prioritise solar-PV to achieve a higher (headline) target share of RE mix of 20% by 2025 in Malaysia’s electricity supply sector. Malaysia’s current usage of RE resources for electricity production is minimal so far (see green “others” category in Malaysia electricity generation mix chart, immediately below). The 2010 plan for Malaysia RE (refer to the next chart) placed solar-PV in the backseat within the RE segment until 2030-2050.

Malaysia electricity generation mix

Source: Malaysia Energy Statistics 2018. Note: Renewable energy sources here are counted under “others” (green) and stands at about 0.6% of the total. Hydro (purple) is large scale and not counted as a RE resource. (1)

Malaysia planned RE electricity generation sources

Source: Annual electricity production from RE resources in Malaysia’s National Renewable Energy Policy and Action Plan (2010). Note: This placed solar-PV in the backseat until 2030-2050.

To achieve its RE commitments, the PH government has announced its plan for an additional 3,991 MW of electricity generation capacity (with details on solar-PV and other RE resources pending) for the Malaysian electricity system.

It is notable that, similar to BN’s policy, PH’s RE policy has only considered RE mix in the electricity supply sector. It has yet to consider RE in the total national energy supply. RE in other energy sectors such as industrial heating and transport to mitigate their significant fossil fuel usage, has not featured in Malaysia policy (2) to date.

Q. Malaysia has large scale hydropower units, with many underpinning the Sarawak Corridor of Renewable Energy. Why are these not part of the RE figures?

In Malaysia, the Renewable Energy Act 2011 defines the various renewable energy resources, indicating for each technology the power capacity limits for incentivised development.

Small hydroelectric plants (mini-hydro; defined as not more than 30MW) are oftentimes not profitable without incentives. Feed-in-tariffs and carbon credits make these projects profitable. Large hydro is not included in the incentivised RE development program as they are usually profitable and have a larger environmental impact than smaller hydro projects. Electricity generated at palm oil mills for self-consumption in business-as-usual scenarios are not included in the Act. Providing incentives for large-scale hydro and palm oil mills (for self-consumption) through feed-in-tariffs and carbon credits schemes may not achieve economically-efficient climate benefits.

Further, mini-hydro plant technology is based on run-of-the-river systems; thus, there is little or no dam on site. This decreases the negative effects versus large hydropower plants that require flooding of (arable) land and disturbances in the temperature and composition of the river water with some negative ecological effects.

The PH administration is attempting to raise the generation capacity limit on small hydro for RE accounting to 100 MW from the 30 MW defined in the Act.

Q. Is PH’s apparent large scale solar push going to deliver a 20% energy mix?

The simple answer is NO. The new policy is dominated upfront by large scale solar-PV (LSS-PV). This is unusual and raises several questions about viability.

The total electricity generation in 2017 was about 162,000 GWh. To meet the target RE ratio within the energy mix in the electricity supply sector, we would need an estimated 32,400 GWh per annum from RE sources. However, if the planned additional generation capacity is predominantly made up of solar-PV, this can only actually contribute meagerly to RE output.

Solar-PV’s has an intrinsically low energy output. Against installed capacity, it is less than 16% in Malaysia. This is because it is in production equivalent to less than 1,400 hours per annum or just over 58 days in a full year.

Solar-PV energy depends upon the vicissitudes of weather (ed: also look at Malaysia’s location in southern ASEAN, a high cloud cover region (3)) and time of day (none at night). It suffers from what is called (a very) “low capacity factor” and high intermittency (irregular output) in comparison with other electricity generation sources, resulting in a relatively low electricity generation rate (ed: see the list below which corresponds with electricity generation rates in a study for Indonesia RE(4)).

The planned additional generation capacity by the PH administration is 3,991 MW (announced last year) and on 15 Nov 2018 an expected cost of RM33 billion for 20% RE was announced, but without much details). If reliant on LSS-PV, this could provide about 5,500 GWh of electricity. Due to the low capacity factor, a 3,991 MW RE (capacity) based on solar-PV can only deliver an added RE of 3.4% in energy output terms.

Thus, it is expected that solar-PV would be balanced with an equal focus on other sources of RE. These have high capacity factors (or electricity generation rates), particularly oil palm biomass. This is needed to meet the overall target. For instance, a generation capacity factor of 92% (close to that of utility power stations), offers a generation equivalent of more than 8,000 hours per annum or about 333 days in a year.

Besides the low capacity factor, any increase in solar-PV generation capacity beyond about 3,000 MW imposes technical limitations due to its intermittency in maintaining stability of the Peninsular Malaysia electricity system at the present load profile in Malaysia.

Comparative generation capacity (utilisation) factors for various renewable resources:

utility power stations with redundant machines 100 %

small-scale biomass 70 %

small-scale biogas 70 %

large scale solar-PV or LSS-PV 16 %

rooftop solar-PV 14 %

Therefore, to meet RE targets, Malaysia will need to supplement RE generation through a ramp up of generation utilising biomass, biogas, small hydro and municipal solid waste (ed: refer to the Indonesia case, where solar may be only 1/5th of the RE segment (6)).

The PH political alliance gave hope for environmental and energy security when their election manifesto declared a focus on green technology development, renewable energy and a promise to reduce CO2 emissions.

To achieve these objectives, the manifesto promised to develop technologies to increase the RE mix in Malaysia’s energy supply to 20% by the year 2025. But we seem uncertain about that promise. We are at 0.6 % RE in 2018 and an LSS drive would add about 3.4% to the electricity supply sector by 2025. PH has yet to publish a roadmap on its strategies and action plans to realise the target of 20% RE (5) in the total national energy supply (its election promise). PH’s RE policy and roadmap requires robust planning and implementation.

Q. How is LSS usually positioned against coal, gas, RE and other sources?

LSS-PV can only provide a limited fraction of RE to the total electricity load demand due to its intrinsic intermittency characteristic. For want of utility-scale energy storage facilities, deployment of LSS-PV would need large hydro or quick-response gas turbine generators to balance supply to demand for frequency regulation, i.e. LSS-PV behaviour requires other power plants to operate in ways that may be difficult or even impossible.

Furthermore, additional capital investment would be required to reinforce or modify the existing electricity network to handle two-way power flows due to its intermittency. Therefore, one needs to consider the LSS-PV generation cost benefit in the context of the generation system as a whole. Deployment of LSS-PV will be challenging at above 3,000 MW capacity (2.2% RE) at the present load profile in Peninsular Malaysia.

There are environmental issues too. Consider the potential loss of open space, agricultural land and biological habitat. Many countries do not allow RE to be situated on agricultural land. The LSS-PV competitive tenders are already causing encroachment and loss of natural forest to locate these plants near designated points of RE injection that are situated close to forest lands.

Q. What materials does Malaysia have a natural advantage and energy security with?

A large resource for RE generation in Malaysia is the excessive amounts of biomass residue from the palm oil sector. There is mesocarp fibre and palm kernel shell that is often needlessly burnt in the boiler of palm oil mills, in a very inefficient manner, to self-power the mills. Energy efficiency improvement at the mills would release large amounts of surplus biomass. This can potentially displace about 22,000 GWh (13.5% of energy mix) of fossil fuel electricity annually in Malaysia. The surplus biomass could also fuel on-site combined heat and power (CHP) systems to provide heat for industrial heating besides electricity generation at high energy-efficiencies.

It would augur well for the RE industry to give high priority to energy efficiency of the palm oil mills and thereby save large amounts of the mesocarp fibre and palm kernel shell (which are process wastes) as renewable resources, and this would also reduce emissions and improve the environmental sustainability of the palm oil industry.

The above potential does not include empty fruit bunches or EFB at the palm oil mills and other agricultural wastes, e.g. palm trunks, paddy husk, timber wastes and others, that could provide for further RE generation.

Q. Why does the potential of palm biomass remain relatively untapped?

The RE industry has had several bad experiences with failed biomass plants in the early period of RE promotion by the government. These failed plants had all used empty fruit bunches (EFB) as fuel and had adopted inappropriate designs without understanding the combustion characteristics of the EFB and the economics of RE generation. As a result, they were plagued by unreliable operation, low generation efficiencies, large transportation costs and a lack of fuel feedstock.

Due to these unaddressed technical problems, the RE industry has convinced Malaysian politicians and bureaucrats of the need to support high (subsidised) feed-in-tariff or FiT rates to justify investment. This is so much so that there is a misconception that oil palm biomass RE is not competitive with other renewable resources and that the take-off of RE will be limited by lack of fuel feedstock.

For a long time, the RE industry has only considered EFB biomass residue available at the mills. This has been understood (wrongly) as being synonymous with biomass in the oil palm industry. The channelling of needless amounts of other biomass residue into boiler furnaces is ongoing and obscured. As a result, the industry does not focus on the more sustainable RE resources of the mesocarp fibre and palm kernel shells (ed: these are in demand from North Asia RE buyers) at the mills.

The government could do well in bringing to the attention of the industry the vast potential for improving energy efficiency of the mills to release large amounts of surplus biomass, and then use it to generate RE. The government needs to alleviate the commonly held misconception that RE cannot take off because of alleged lack of suitable fuel feedstock. A full-scale demonstration plant to deliver this potential (ed: the author has developed such a design) is required to spearhead the revolution. This would truly initiate a paradigm shift.

Krishna is an energy efficiency and renewable energy expert for palm oil mills and a project engineer at Tenaga Nasional Berhad in the earlier part of his career. With an in-depth knowledge of energy efficiency and tapping renewable resources, he offers valuable insight into relationships between renewable energy and distributed generation performance and economic expectations. This expertise may prove helpful in turning environmental challenges into economic solutions.

Data-info addendum by Khor Reports, 11 Nov 2019

A. High cloud cover (over 60-70%) in the tropical belt including southern ASEAN gives the region a lower potential power from photovoltaic than northern ASEAN.

Source: Nasa Earth Observations

Cloud Fraction, February 2000 to September 2019, NASA (2019). Note: These maps show what fraction of an area was cloudy on average each month. The measurements were collected by the Moderate Resolution Imaging Spectroradiometer (MODIS) on NASA's Terra satellite. Colors range from blue (no clouds) to white (totally cloudy). Like a digital camera, MODIS collects information in gridded boxes, or pixels. Cloud fraction is the portion of each pixel that is covered by clouds. Colors range from blue (no clouds) to white (totally cloudy).

Comment: Lower cloud cover (darker-darkest blue, upper map) is closely linked to higher photovoltaic or PV power potential (red-dark orange, lower map) and higher cloud cover (white-light blues) is closely linked to lower PV power potential (yellow in tropical belt lower latitudes and light-green violets in high latitudes)

Global spatial distribution of the average cloud cover of Sentinel-2A and Sentinel-2B Level-1C scenes acquired in the year 2017, Sudmanns et al. (2019).

B. Photovoltaic power potential (7) for Malaysia (and the rest of southern ASEAN) is significantly below the global average in a 730-2337 kWh/KWp range.

C. Cost and utilisation rates, plus policy comparative context for Indonesia. A 2019 study puts solar at just over 1/5th of the RE category, in a “RE medium” scenario with 31% RE for 2027F.

It is instructive to look at Indonesia as a comparative case study. Liebman et al. (2019) (8) analyses an "RE medium" scenario for Indonesia for 31% RE by 2027, comprising 11% geothermal, 8% hydro, 7% solar and 5% wind. Thus, solar could be just over 20% of their RE category. It appears that many planners add solar-PV build up at a later stage once more steady and higher utilisation rate RE sources have built up. Interestingly, the study does not include biogas and biomass as major contributors to RE. Perhaps the various costs are a significant factor, together with there being a less established base of technology, implementation and expertise in the region? To be sure, the ramp up in solar-PV equipment production by China state-owned enterprises (including in Malaysia to make it a top 3 production base origin) has offered comfort to those buying these systems, and solar-PV implementation seems like an easy thing to gun for, but has to be considered against its technical limitations.

D. Malaysia’s transition into higher RE mix by 2025 (9)

Malaysia’s transition into a higher RE mix by 2025 is estimated to contribute to over 100,000 in employment opportunities, of which 39% will be in mini hydro, biomass (28%) and biogas (11%).

Rooftop solar and large scale solar will make up about 22% of the projected employment figure.

Footnotes

Ed: Under the 2010 plan, there should be 4,000 MW of RE cumulative capacity by 2030F for cumulative avoided CO2 avoided of 145.1 mt. End 2011, there was 65MW of installed capacity mostly from biomass plants in Sabah, the Sustainable Energy Development Authority / SEDA reported.

Ed: The push for B20 palm biodiesel seems more to do with absorbing more palm oil domestically, amidst angst about Malaysia exports of palm oil (and its competition for markets with Indonesia and other palm producers).

Look at “Data-info addendum by Khor Reports, 11 Nov 2019”.

Look at “Data-info addendum by Khor Reports, 11 Nov 2019”.

Ed: Based on the announcement in Oct 2019, RM33,000 million, would be USD 7,951.81 million (at USD/MYR 4.15). If that is associated with 6,900.00 MW, that is 1,152.44 USD per kW equivalent.

Look at “Data-info addendum by Khor Reports, 11 Nov 2019”.

https://themalaysianreserve.com/2019/10/11/re-goals-to-attract-rm33b-in-private-investments/

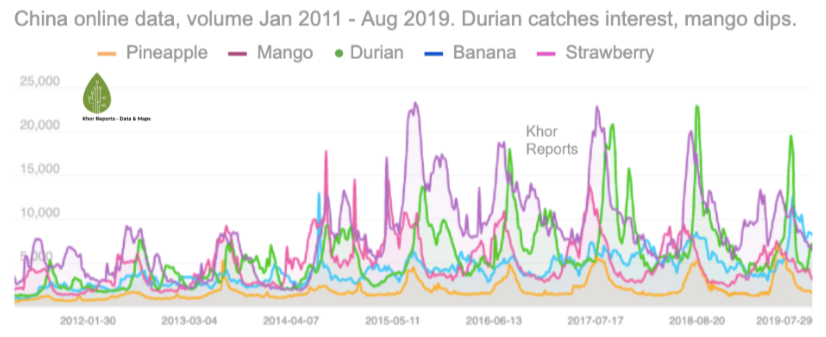

![FireShot Capture 047 - [Draft] Waste Plastics, Durian & Bubble Tea text - Google Docs_ - docs.google.com.png](https://images.squarespace-cdn.com/content/v1/5aa8dd09c258b49f01414e50/1571388937071-J0BHVK9DEEEDYLYOS5O1/FireShot+Capture+047+-+%5BDraft%5D+Waste+Plastics%2C+Durian+%26+Bubble+Tea+text+-+Google+Docs_+-+docs.google.com.png)