Sime Darby lately announced a few proposed ventures overseas, including exploring a potential 300,000ha plantation landbank in Cameroon.

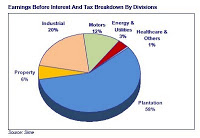

In its 18th March 2011 research note entitled "Sime Darby – Malaysia, Too early to add more overseas ventures," UOB Kay Hian research notes that, "Notwithstanding the risks associated with investments in Africa, this venture could divert the new management’s focus from re-examining and streamlining its current business divisions........ Sime is planning to build a processing plant in France which would receive palm oil feedstock from its Liberia estates. This move faces the challenges of meeting Europe’s high oil quality requirements as well as strong resistance from the environmental movement in Europe against palm oil...." (On left, UOBKH graphic with data from Sime Darby, showing the earnings by division of the Malaysian conglomerate)

with investments in Africa, this venture could divert the new management’s focus from re-examining and streamlining its current business divisions........ Sime is planning to build a processing plant in France which would receive palm oil feedstock from its Liberia estates. This move faces the challenges of meeting Europe’s high oil quality requirements as well as strong resistance from the environmental movement in Europe against palm oil...." (On left, UOBKH graphic with data from Sime Darby, showing the earnings by division of the Malaysian conglomerate)

Khor Reports comment:

a) Sime currently operates in Liberia with under 10,000ha, but has potential to increase this to 220,000 ha. With perhaps another 300,000 ha from Cameroon, this could ramp up Sime's already large landbank reserves substantially.

b) Old-style plantation expansion in Malaysia did not require corporate growers to set-aside land for smallholder development (Felda was the land agency that focussed on smallholder efforts). Indonesia requires corporate land concession holders to set aside some 20% for smallholder development. Sime's planned new project in Sarawak will give substantially more allocation to indigenous land owners and a state land agency under an improved 'native customary rights' program. Thus, there is an increasing trend toward higher allocations for smallholders. Oil palm growing in Africa is characterized by significant smallholder interests and it is likely that corporates will be required to give larger allocations for these.

c) The proposed processing plant in France is a move toward creating a segregated supply chain (perhaps of sustainable smallholder palm oil??) direct to the end market in Europe. Such a supply chain is the goal of global giants Cargill and Wilmar, and large Malaysian planters such as KL Kepong and IOI Corp. Mid-sized, Europe-oriented players, United Plantations (affiliated with Aarhus) and New Britain Palm Oil have also made a similar moves, with the latter even building a dedicated supply for confectionary maker, Ferrero Rocher.

In its 18th March 2011 research note entitled "Sime Darby – Malaysia, Too early to add more overseas ventures," UOB Kay Hian research notes that, "Notwithstanding the risks associated

with investments in Africa, this venture could divert the new management’s focus from re-examining and streamlining its current business divisions........ Sime is planning to build a processing plant in France which would receive palm oil feedstock from its Liberia estates. This move faces the challenges of meeting Europe’s high oil quality requirements as well as strong resistance from the environmental movement in Europe against palm oil...." (On left, UOBKH graphic with data from Sime Darby, showing the earnings by division of the Malaysian conglomerate)

with investments in Africa, this venture could divert the new management’s focus from re-examining and streamlining its current business divisions........ Sime is planning to build a processing plant in France which would receive palm oil feedstock from its Liberia estates. This move faces the challenges of meeting Europe’s high oil quality requirements as well as strong resistance from the environmental movement in Europe against palm oil...." (On left, UOBKH graphic with data from Sime Darby, showing the earnings by division of the Malaysian conglomerate)Khor Reports comment:

a) Sime currently operates in Liberia with under 10,000ha, but has potential to increase this to 220,000 ha. With perhaps another 300,000 ha from Cameroon, this could ramp up Sime's already large landbank reserves substantially.

b) Old-style plantation expansion in Malaysia did not require corporate growers to set-aside land for smallholder development (Felda was the land agency that focussed on smallholder efforts). Indonesia requires corporate land concession holders to set aside some 20% for smallholder development. Sime's planned new project in Sarawak will give substantially more allocation to indigenous land owners and a state land agency under an improved 'native customary rights' program. Thus, there is an increasing trend toward higher allocations for smallholders. Oil palm growing in Africa is characterized by significant smallholder interests and it is likely that corporates will be required to give larger allocations for these.

c) The proposed processing plant in France is a move toward creating a segregated supply chain (perhaps of sustainable smallholder palm oil??) direct to the end market in Europe. Such a supply chain is the goal of global giants Cargill and Wilmar, and large Malaysian planters such as KL Kepong and IOI Corp. Mid-sized, Europe-oriented players, United Plantations (affiliated with Aarhus) and New Britain Palm Oil have also made a similar moves, with the latter even building a dedicated supply for confectionary maker, Ferrero Rocher.