During the panel discussion, Fahrulrazy from MITI pointed to the huge market under RCEP, specifically China and its approximately 1.4 billion population; including advantages to producers and manufacturers for sourcing raw materials within the trade area, to help increase productivity and growth. But specifics of using the provisions of RCEP versus other Malaysia-China trade arrangements e.g. China-ASEAN FTA or CAFTA were not elaborated on.

The speaker from Deloitte provided some comparison of tariffs from different trade agreements and used a few case study illustrations including on Malaysia petrochemicals exported to the Middle East via Indonesia. Interestingly, there was some disagreement between the speakers on which Rules of Origin or ROO to apply.

Concerns were raised by Dr Juita on the lack of labour and environmental chapters in the RCEP. There are 20 chapters in RCEP that covers ROO, Customs Procedures and Trade Facilitations, Sanitary, Trade in Services and Competition. You can find all the chapters here. The panel shared that it is difficult to get a consensus on human rights. All signatories must be ready to agree on it.

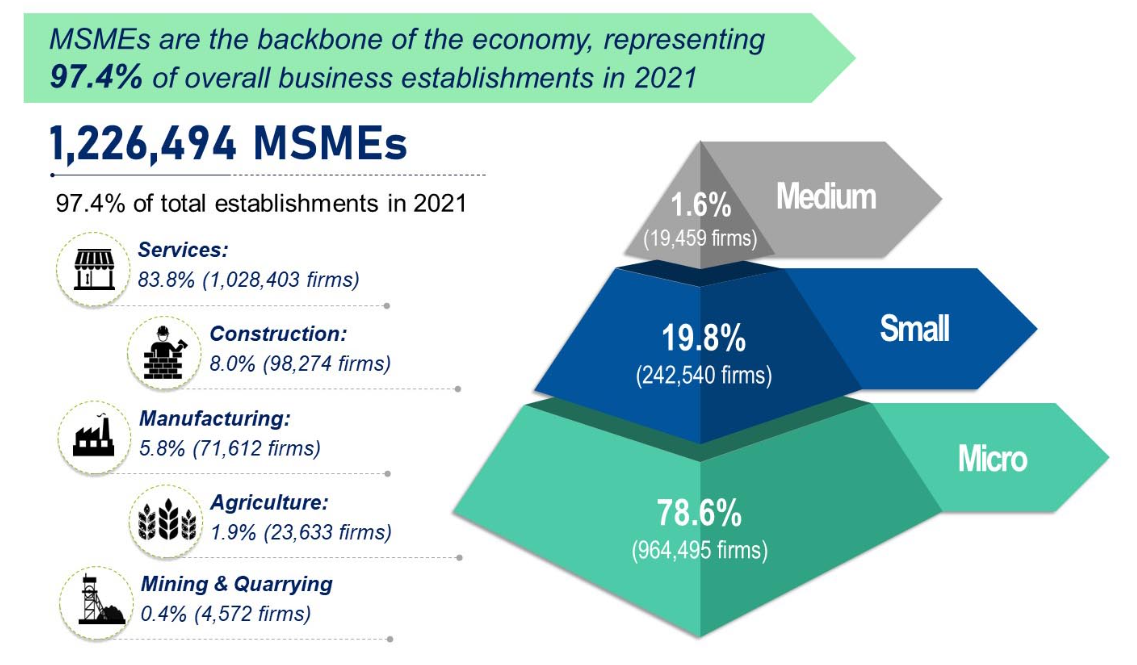

There were about 80 participants and they included business owners, agencies and regulators. The worries from the floor were on small-medium enterprises (SMEs) and their cost worries. For SMEs to participate in RCEP, there are costs to administer and apply to enjoy the provisions of RCEP (or other trade deals). SMEs have to be on their toes to understand which trade deal provisions they can avail themselves of; with constant monitoring and assessments. To this end, government support is vital. For example, the Singaporean government provides grants to SMEs to assess their readiness to export their products.

Moreover, there can also be risks to SMEs, most of the speakers cautioned on increased competition for certain sectors due to more imports. A key speaker pointed out that the agreement has come at the wrong time when many businesses are still recovering from the pandemic; and many SMEs will not have the financial capability to upgrade their businesses. There is an ongoing problem of SMEs not exporting, as they do not have the capacity to do so.

A participant pointed out that only major businesses in Malaysia are exporting. In fact, not many SMEs are using MATRADE programs. MATRADE was asked whether any studies were conducted to determine which Malaysian products would have a comparative advantage under RCEP (compared to trade competitors). As this study is ongoing, we should await the publication of its findings. The expected date of publication of this report was not disclosed.

Note: MATRADE reported in 2019 that local SMEs only contributed about 18 per cent in export despite making up 98 per cent of Malaysian business establishments.