Khor Yu Leng, from Segi Enam, was part of a panel during POC2023 titled "Palm Oil Sustainability: The Way Forward", which was cleverly moderated by Datuk Darrel Webber with football analogies. Other panellists included Joseph D'Cruz from RSPO, Perpetua George from Wilmar International Limited, Renaka Ramachandran from Sime Darby Plantation, and Tan Chee Yong from MPOCC.

During the Panel Discussion - Palm Oil Sustainability: The Way Forward. [From the left: Tan Chee Yong (MPOCC), Renaka Ramachandran (SDP), Perpetua George (Wilmar), Joseph D’Cruz (RSPO), Khor Yu Leng (Segi Enam) and Darrel Webber (IRGA)]

Panellists on stage receiving tokens of appreciation from Bursa Malaysia.

During the panel discussion, speakers discussed the challenge of meeting the constantly evolving sustainability standards and how companies always needed to catch up with the moving “goalpost”. The business sector representatives shared that certification bodies always add new standards, making it difficult for businesses to anticipate or prepare to ensure they meet the standards to remain certified.

Joseph, of the RSPO, explained that new sustainability standards are not added arbitrarily, but rather in response to environmental factors. The industry, must understand where it should move towards and consider drivers and trends to meet the demands for sustainability and greater transparency from the market.

Yu Leng highlighted the sustainability progress within the industry, citing a 20% growth in certified growers who have embraced the opportunities presented by certification. She also noted a decrease in certification costs and increasing demand for sustainable palm oil and good premia, which might be off-putting for buyers. Recent new planting data from RSPO showed that 43% of estates are now developed on grassland and other areas (non-deforestation), while 24% of such landbank are conservation areas.

Renaka described SDP’s activities at the forefront of sustainability as there is a lot of demand from customers and stakeholders. She acknowledged that the goalpost for sustainability standards is constantly changing and improving. Businesses should prioritize decarbonization and take action as soon as possible. (Editor’s Note: Let’s all say yes, to continual improvement! While keeping an eye on the cost effectiveness ways to achieve this.)

The discussion then shifted to regulatory standards, focusing more on the EU non-Deforestation Regulation (EUDR). Yu Leng noted that the 2020 cut-off includes millions of hectares of conversion, but a central/national registry is required to benefit from it. Indonesian smallholders are optimistic as this is a pathway for them to enter the EU market. This aligns with our read that the EU is making efforts to be more pro-smallholder (after criticisms from some countries). Attesting to this is an update that smallholders of up to 4 hectares can use geolocation points (rather than shape files of their farms).

Wilmar’s Perpetua believes that Malaysia is a low-risk country under the EUDR. She cited several reasons for her opinion, including the fact that Malaysia's certification for palm oil is now mandatory under the Malaysian Sustainable Palm Oil (MSPO) regulation, and oil palm dealers are also required to obtain MSPO certification. Additionally, Malaysia's major expansion in oil palm cultivation occurred before the 2020 cut-off date of the EUDR. Finally, Malaysia has readily available palm oil data that can be compiled and presented to meet regulatory requirements. (Editor’s Note: Not sure if Malaysia can be classified as a low-risk country as this is based on sector annualized growth rate of production areas and such; but by virtue of Malaysia’s administrator bureaucracy and its data, it can be easily demonstrated as low-risk to comply with the EUDR, if there is an effort to do this.)

On the labour issue, Perpetua noted it is “a big scapegoat issue,” but this is also a problem for other commodities. However, finding a solution to this problem is difficult as it requires action from the government. Other speakers agreed that it is a politically sensitive issue that government administrations may be hesitant to tackle as it could have negative consequences. (Editor’s note: This likely relates to the problem of granting rights to migrant workers. Doing so might anger voters).

On the future of certification and whether it is still relevant now with EUDR, MPOCC’s Chee Yong shares that as more and more criteria are being added and now regulations are being introduced, there needs to be a centre point to see how this is workable. Certification bodies can be the centre point, but government effort is needed as well. For RSPO, Joseph said that it is a space for the industry to allow companies to convene for discussions. That was how RSPO was formed.

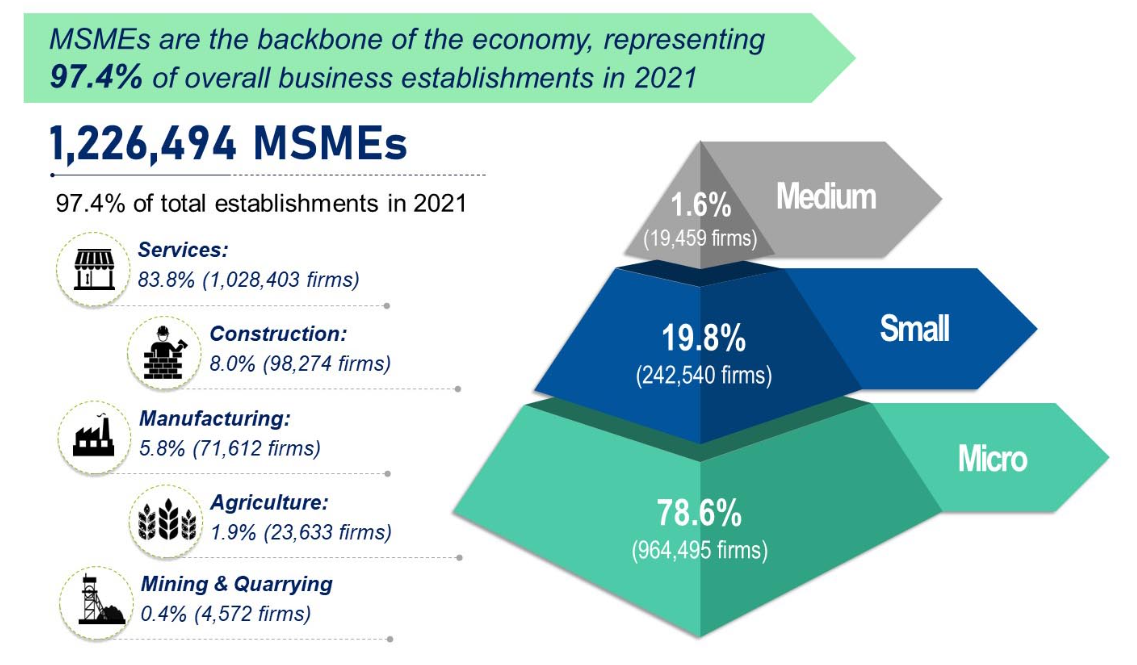

The speakers discussed how MSPO and RSPO can be more proactive. Yu Leng suggested that Malaysia could establish a national or central registry and become more data-ready, especially for the SME sector. More financial institutions are willing to provide green funding to companies, indicating a growing market for sustainable products. Joseph noted that sustainability standards serve as a measuring tape to assess companies' compliance and that the industry is accountable to those who set the bar.

There was a question from the floor regarding certification fatigue. Renaka shared that there is value in aligning with sustainability measurements. It is now part of a company’s image. Yu Leng worried that the narrative is misguided by a minority of the stakeholders. She suggests companies use certification and sustainability for business opportunities e.g., how do you participate in supply for Sustainable Aviation Fuel (SAF) that Argus notes is now around USD3,000/tonne (versus below USD1,000 for palm oil)? Top buyers want reliable data from suppliers.

Read our other post about POC2023:

Reported by Wong Ivan (ivan.segienam@gmail.com) | 27 March 2023 (Edited on 4 April 2023, 9:00am. Updated data from RSPO on new planting data.