Editor's note: I've always had this topic as something to cover, but never settled down to it. Will start to gather some links on this now.

Note: Just to share research info. Not all info has been put in - bonus rates. Please check TH annual reports for most accurate info.

Tabung Haji confirms Bank Negara’s warning, says deposits safe BY ANISAH SHUKRY 26 January 2016; ....Lembaga Tabung Haji today confirmed Bank Negara had warned it in a letter that its liabilities outweighed its assets, but assured contributors that their deposits were safe and that the pilgrims' fund was not facing any financial difficulty. It said Bank Negara's evaluation had not taken into account the pilgrims fund's investment portfolios, such as the shares of its subsidiaries, its plantation assets and property. - See more at: http://www.themalaysianinsider.com/malaysia/article/tabung-haji-confirms-bank-negaras-warning-says-deposits-safe#sthash.1OAmfgeQ.dpuf

Bank Negara lauds Tabung Haji’s bolstering of finances BY ANISAH SHUKRY 26 January 2016; ...nearly nine million depositors... Meanwhile, Bank Negara today said it issued advisories to non-bank financial institutions such as Tabung Haji to ensure they continued to be well managed and performed their roles effectively. - See more at: http://www.themalaysianinsider.com/malaysia/article/bank-negara-lauds-tabung-hajis-bolstering-of-finances#sthash.weQzDPr0.dpuf

Tabung Haji reserves in the red, warns Bank Negara BY ANISAH SHUKRY 26 January 2016; ....Tabung Haji reportedly has only 98 sen in assets for every RM1 in liability. Bank Negara says its predicament is because of the practice of declaring higher dividends than it can afford... Tabung Haji’s deposits were highly concentrated among a small number of contributors – 5% of whom owned 75% of the total deposits. This exposed the pilgrims’ fund to the risk of a mass withdrawal of deposits, should contributors lose faith in it, she said....Last year, Tabung Haji courted controversy when it purchased 0.64ha land in Tun Razak Exchange (TRX) for RM188 million from 1Malaysia Development (1MDB) to develop a residential tower. It paid 43 times the price the debt-ridden 1MDB had paid for the plot, which it bought from the federal government five years ago. Following public backlash, Tabung Haji in May vowed to sell off the land at a profit, but until today, there has been no news of the sale. - See more at: http://www.themalaysianinsider.com/malaysia/article/tabung-haji-reserves-in-the-red-warns-bank-negara#sthash.2U5fumU0.dpuf

Tabung Haji 2014 Annual Report info and link here:

27 Jan 2016: Tabung Haji spotlight, assurance deposits safe

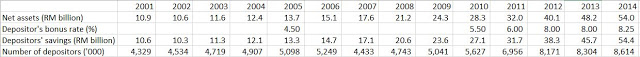

Editor's note: some indicators compiled from TH annual reports here:Note: Just to share research info. Not all info has been put in - bonus rates. Please check TH annual reports for most accurate info.

Tabung Haji confirms Bank Negara’s warning, says deposits safe BY ANISAH SHUKRY 26 January 2016; ....Lembaga Tabung Haji today confirmed Bank Negara had warned it in a letter that its liabilities outweighed its assets, but assured contributors that their deposits were safe and that the pilgrims' fund was not facing any financial difficulty. It said Bank Negara's evaluation had not taken into account the pilgrims fund's investment portfolios, such as the shares of its subsidiaries, its plantation assets and property. - See more at: http://www.themalaysianinsider.com/malaysia/article/tabung-haji-confirms-bank-negaras-warning-says-deposits-safe#sthash.1OAmfgeQ.dpuf

Bank Negara lauds Tabung Haji’s bolstering of finances BY ANISAH SHUKRY 26 January 2016; ...nearly nine million depositors... Meanwhile, Bank Negara today said it issued advisories to non-bank financial institutions such as Tabung Haji to ensure they continued to be well managed and performed their roles effectively. - See more at: http://www.themalaysianinsider.com/malaysia/article/bank-negara-lauds-tabung-hajis-bolstering-of-finances#sthash.weQzDPr0.dpuf

Tabung Haji reserves in the red, warns Bank Negara BY ANISAH SHUKRY 26 January 2016; ....Tabung Haji reportedly has only 98 sen in assets for every RM1 in liability. Bank Negara says its predicament is because of the practice of declaring higher dividends than it can afford... Tabung Haji’s deposits were highly concentrated among a small number of contributors – 5% of whom owned 75% of the total deposits. This exposed the pilgrims’ fund to the risk of a mass withdrawal of deposits, should contributors lose faith in it, she said....Last year, Tabung Haji courted controversy when it purchased 0.64ha land in Tun Razak Exchange (TRX) for RM188 million from 1Malaysia Development (1MDB) to develop a residential tower. It paid 43 times the price the debt-ridden 1MDB had paid for the plot, which it bought from the federal government five years ago. Following public backlash, Tabung Haji in May vowed to sell off the land at a profit, but until today, there has been no news of the sale. - See more at: http://www.themalaysianinsider.com/malaysia/article/tabung-haji-reserves-in-the-red-warns-bank-negara#sthash.2U5fumU0.dpuf

Tabung Haji 2014 Annual Report info and link here: