In December 2021, heavy rainfall had resulted in severe flooding in numerous areas within Peninsular Malaysia. Regarded as one of the worst flood disasters the country has seen in the recent years, the flood effectively displaced an estimated tens of thousands of residents and was further proof that Malaysia is not—and will not be—spared from the growing effects of climate change.

Malaysia has yet to forget the devastation the floods had caused—topic of climate change is becoming an increasingly important and popular one, particularly online. Accordingly, activists and environmentalists have taken the opportunity to highlight the gravity of the situation, oftentimes working hand-in-hand with the media as a platform where the public can be kept abreast about the matter.

Kini News Lab is one such platform and its most recent article is “When the Water Rises: A Malaysian Climate Change Story,” which described how climate change has adversely impacted the livelihoods, standards of living, and psychology of Malaysians across the country. The article also allows readers to see annual temperature and rainfall changes in various locations since 1952.

A part of the article also covered rising sea water levels, yet another threat Malaysia is facing as a direct result of climate change. In the worst case scenario for Malaysia, sea levels could very well rise up to 0.74 metres by the 2100 year, plunging low lying and coastal areas underwater.

Source: Kini News Lab (2022)

Khor Reports did a short review several years ago comparing between the best and worst case scenarios for key areas where the land is at risk of coastal flooding by 2050: Land Reclamation Projects and Sand Dredging/Mining Sites in Peninsular Malaysia ver. Oct 2019.

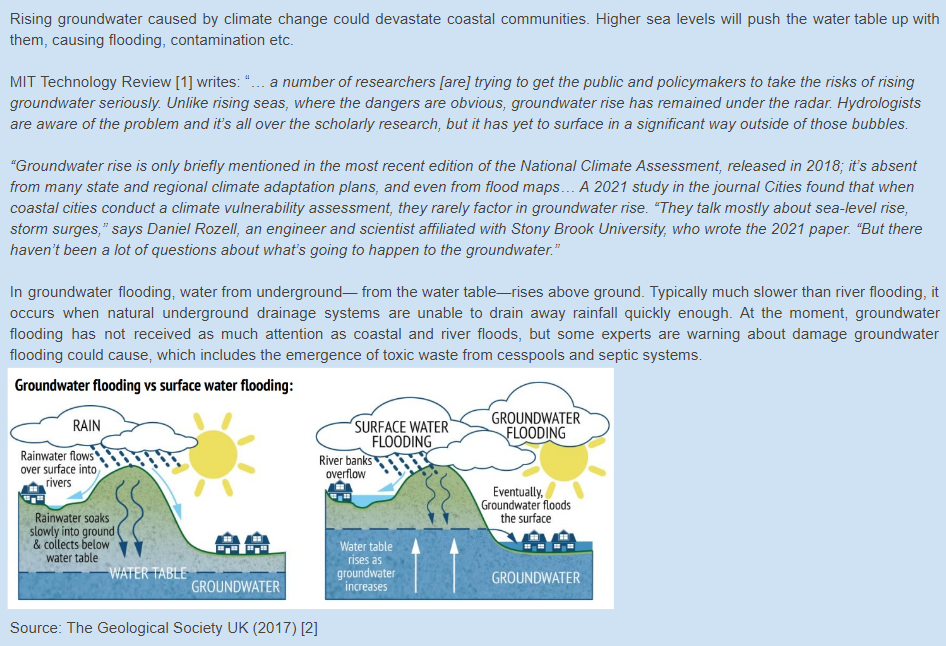

We also wrote a piece on the politics of floods, with criticism about land development coming from businessmen and bureaucrats interviewed: Malaysia - the Political Economy of Land Development (or the Politics of Flood). While attention on coastal and flash floods is gaining attention, we would also like to highlight the issue of ground water flooding that can worsen flood woes (see box below).