26 Jan 2017: Saudi Aramco not going ahead with Petronas for Johor project - RAPID

Saudi Aramco not going ahead with Petronas for Johor project: WSJ 25 January 2017 Read more at http://www.thestar.com.my/business/business-news/2017/01/25/saudi-aramco-not-going-ahead-with-petronas-for-johor-project-wsj/#LKtPTGvDSORu0kVq.99

Earlier news:

- Petronas decision on Rapid deal with Aramco in Dec? 28 OCTOBER 2016 -- Petroliam Nasional Bhd (Petronas) is said to be making a final investment decision in December to partner with Saudi Arabian Oil Co (Saudi Aramco) by offering a 50 per cent stake in its refinery and petrochemical integrated development project (Rapid) in Johor. According to the Wall Street Journal (WSJ) report yesterday, if Petronas proceeds with the plan, the two companies will set up a joint-venture company in the first quarter of next year to run the project, with the refinery due to start operating in early 2019. Read More : http://www.nst.com.my/news/2016/10/183983/petronas-decision-rapid-deal-aramco-dec

- Petronas-Aramco seek $10b loan for Johor project SEP 30, 2016 - Talks with banks have begun; however, analysts say profit squeeze could force rethink of Canadian gas plans - Malaysia's national oil corporation Petronas and the Saudi Arabian Oil Company (Saudi Aramco) have begun negotiations with Malaysian-based banks to raise a record US$7.5 billion (S$10 billion) syndicated loan to finance a planned refinery and petrochemical complex in Johor. Bankers familiar with the loan syndication said that the 50-50 joint venture between the two international oil giants will be a straight-forward loan ahead of a much larger bond issue further down the road to finance the Refinery and Petrochemical Integrated Development Project, or Rapid, as it is called in the Pengerang industrial zone in Johor. http://www.straitstimes.com/asia/se-asia/petronas-aramco-seek-10b-loan-for-johor-project

- Petronas Could Soon Seal Partnership With Saudi Aramco on $21 Billion Refinery - Malaysia’s state oil firm in December is expected to offer the Saudi Arabian giant a 50% stake in the project By YANTOULTRA NGUI Oct. 27, 2016 http://www.wsj.com/articles/petronas-could-soon-seal-refinery-partnership-with-saudi-aramco-1477545192

Note: Customised news update is available for 29 Sep 2016 - 26 Jan 2017

29 Sep 2016: Petronas-led LNG project gets Canada approval amidst China deals tilt

Editor's note: Canada approves Petronas-led $27 bln LNG complex. Reports say Petronas is in no rush to start. The view from KL is that this is an important plus for Petronas. It's good news as a continued stall would have dragged Petronas - this is its single largest project. A significant stake had been sold to China interests. The view from a Canada businessman is that this is good for Canada. Low oil prices have hit Alberta. LNG is clean fuel, although there is some environmental impact from this project. Note: Canada and China recently signed various state level MOUs. Thus, both Malaysia and Canada have had state-level or G2G agreements with China.

Federal government approves $11.4-billion LNG project in B.C. September 28, 2016 -- Pacific NorthWest LNG has been one of the leading LNG project proposals for several years, along with the Shell-led $25-billion LNG Canada project in Kitimat and the Chevron-led $12-billion Kitimat LNG project. Shell and Chevron have secured federal and provincial environmental approvals, plus First Nations support at the terminal, and significant support along their pipeline routes.....But the Greater Vancouver Board of Trade welcomed the announcement, which it noted is subject to 190 conditions, and includes up to $2.5 billion in annual tax revenue and nearly $3 billion in annual contributions to Canada’s GDP. “The Pacific NorthWest LNG project will energize the Canadian economy,” said the board of trade’s president and CEO, Iain Black. http://vancouversun.com/news/local-news/feds-flying-to-vancouver-for-historic-lng-decision-expected-to-ok-megaproject

Canada approves $36 bn LNG project, eyes Asia 28 Sep 2016 -- The project includes a pipeline and two Petronas terminals to ship gas to Asia. The gas terminals are to be built on Lelu Island, near Prince Rupert on the Pacific coast. Each will have a capacity of six million tons per year, with the possibility of adding a third down the road. The pipeline built by the operator TransCanada must cross 900 kilometers of British Columbia between Hudson's Hope (about 400 kilometers or 250 miles north of Prince George), ending at Lelu Island. The pipeline deal comes after Petronas in late 2012 snapped up Canada's Progress Energy Resources gas producer for USD 5.2 billion.

The deal means heavy LNG traffic through a maze of islands where salmon is a vital resource. However, others were upbeat about job opportunities. The green light for the pipeline project comes a few weeks after a key meeting between federal and provincial governments to define the necessary steps to reduce carbon emissions under last year's Paris climate agreement.

Read more at: http://www.moneycontrol.com/news/wire-news/canada-approves-usd-36-bn-lng-project-eyes-asia_7534301.html?utm_source=ref_article

Pacific NorthWest LNG, a consortium comprised of Petroliam Nasional Berhad (Petronas 62%), Japan Petroleum Exploration Company (JAPEX 10%), PetroleumBRUNEI (3%), Indian Oil Corporation (10%) and China Petrochemical Corporation (Sinopec 15%). http://www.hydrocarbons-technology.com/projects/pacific-northwest-lng-project/

Fastest Asia-U.S. Shipping Route? Canada’s Ports http://www.wsj.com/articles/fastest-asia-u-s-shipping-route-canadas-ports-1418335017

China, Canada resolve canola-shipping dispute; to boost trade ties SEPTEMBER 22, 2016 By David Ljunggren and Rod Nickel http://atimes.com/2016/09/china-canada-resolve-canola-shipping-dispute-to-boost-trade-ties/

Strengthening of Canada-China commercial relationship September 1, 2016 http://pm.gc.ca/eng/news/2016/09/01/strengthening-canada-china-commercial-relationship

Canada to Join China-Led Infrastructure Bank in Win for Xi by Bloomberg News August 31, 2016 http://www.bloomberg.com/news/articles/2016-08-31/canada-to-join-china-led-infrastructure-bank-in-victory-for-xi

Canada to Join China-Led Infrastructure Bank in Win for Xi by Bloomberg News August 31, 2016 http://www.bloomberg.com/news/articles/2016-08-31/canada-to-join-china-led-infrastructure-bank-in-victory-for-xi

29 August 2016: Sarawak and Sabah reps on Petronas board after Sarawak staffing tussle

After Sarawak, Sabah rep to join Petronas board Sunday August 28, 2016 - See more at: http://www.themalaymailonline.com/malaysia/article/after-sarawak-sabah-rep-to-join-petronas-board#sthash.49Leg91p.dpuf

Sarawak says ‘not in picture’ over Petronas’ oil production share with foreign firms Sunday August 28, 2016 - See more at: http://www.themalaymailonline.com/malaysia/article/sarawak-says-not-in-picture-over-petronas-oil-production-share-with-foreign#sthash.m8P0fhWc.dpuf

Petronas, Sarawak resolve seven staffing issues, says Adenan 22 comments Edward Subeng Stephen, Bernama Published 27 Aug 2016 https://www.malaysiakini.com/news/353829

End to Petronas-Sarawak controversy by fintan ng and p aruna 23 August 2016 http://www.thestar.com.my/business/business-news/2016/08/23/end-to-controversy/

Sarawak DAP mulls taking Petronas hiring issue to Parliament Tuesday August 23, 2016 - See more at: http://www.themalaymailonline.com/malaysia/article/sarawak-dap-mulls-taking-petronas-hiring-issue-to-parliament#sthash.ki8Tg7QT.dpuf

Petronas: Most workers needed in Sarawak will be from the state 10 August 2016 | MYT 9:39 AM http://www.thestar.com.my/business/business-news/2016/08/10/petronas-most-workers-needed-in-sarawak-will-be-from-the-state/

Work permit freeze due to real hiring bias, Sarawak DCM tells Petronas BY SULOK TAWIE Wednesday August 10, 2016 - See more at: http://www.themalaymailonline.com/malaysia/article/work-permit-freeze-due-to-real-hiring-bias-sarawak-dcm-tells-petronas#sthash.e8w5lbJt.dpuf

Petronas to explain decision in terminating employees from Sarawak 8 August 2016 | MYT 9:35 PM http://www.thestar.com.my/news/nation/2016/08/08/petronas-to-explain-decision-in-terminating-employees-from-sarawak/

14 August 2016: Petronas Sarawak staff retrench woes, oil and gas company woes in Singapore and Malaysia

State will be fair in immigration dealings with Petronas staff: Nancy August 14, 2016, Sunday Churchill Edward... KUCHING: A Sarawakian minister in the Prime Minister’s Department assured citizens that the state government will be fair in the dealings with immigration involving national petroleum corporation Petronas staff. The minister Nancy Shukri was reacting to the recent action taken by the Sarawak government led by Chief Minister Datuk Patinggi Tan Sri Adenan Satem following grouses expressed by Sarawakians over Petronas selection of manpower.

Nancy said: “I have been following the arguments on the drastic action taken by the Sarawak state government against Petronas. It was clearly stated by the Sarawak state government that any new applications for work permits from Petronas have been frozen as a result of complaints from Sarawakian Petronas officers whose services were terminated and retrenched as revealed by Suarah Petroleum Group. (SPG). It is a normal action by the state.”... She added that the action was based on the complaints by the SPG and definitely there was a basis to the complaints. “The action against Petronas was the first after 1963 using the autonomy power of the state through immigration law.... Secondly, it was an isolated and independent action upon receiving complaints from SPG and Sarawakians as a whole. However. she opines sit also reflects that Sarawakians are becoming more aware of their rights under the constitution and the state government has to act accordingly for the interests of Sarawakians under the constitution. “I would say that it is nothing to do with the devolution issues since the negotiation is in progress and committment given by the federal government is very positive....... http://www.theborneopost.com/2016/08/14/state-will-be-fair-in-immigration-dealings-with-petronas-staff-nancy/

http://www.theedgemarkets.com/my/article/og-meltdown-will-there-be-more-casualties

12 July 2016: PETRONAS reaches cessation deal with SapuraKencana, Petrofac for Berantai

PETRONAS Reaches Deal with SapuraKencana, Petrofac for Berantai by Chee Yew Cheang Rigzone Staff July 11, 2016 -- Malaysia's national oil company (NOC) Petroliam Nasional Berhd (PETRONAS) announced Monday that it has reached an agreement with Petrofac Energy Developments Sdn Bhd and SapuraKencana Petroleum Berhad's subsidiaries Kencana Energy Sdn Bhd and Sapura Energy Ventures Sdn Bhd for the cessation of the Berantai Risk Service Contract (RSC) located in Block PM 309 offshore Terangganu, Malaysia. "The RSC’s cessation will allow PETRONAS to minimize the project’s long-term value erosion and optimize the development and production activities in Malaysia, in line with its efforts to reduce costs and increase the efficiency of its operations," the state-owned firm said in the press release. PETRONAS will reimburse the balance of outstanding capital and operational expenditures to the contractors over the following 12 months following the RSC cessation that will take effect Sept. 30. Under the agreement, the contractors will transfer ownership of the Berantai FPSO (floating production, storage and offloading) facility to the NOC. http://www.rigzone.com/news/oil_gas/a/145560/PETRONAS_Reaches_Deal_with_SapuraKencana_Petrofac_for_Berantai

16 May 2016: Sarawak seeks to regulate Petronas activities within state - says Federal Government has no authority to issue licences

Sarawak seeks to regulate Petronas activities within state BY SULOK TAWIE June 15, 2016 -- Sarawak Chief Minister Tan Sri Adenan Satem announced today the state government’s plans to regulate the seabed and subsoil activities of national oil company Petronas and its contractors within its territory. He said Sarawak’s regulatory framework would be based on relevant state laws to which Petronas and its contractors would have to abide. “Petronas, a corporation having rights to prospect and mine petroleum both offshore and onshore under the Petroleum development Act, 1974, will have to be regulated and abide by the provisions of the Oil Mining Ordinance of Sarawak and the Land Code in regard to the use and occupation of State Land within the boundaries of Sarawak for the prospecting and mining of petroleum,” he said when winding up the debate in the state assembly here. He said the Land Code of Sarawak, which came into effect on January 1, 1959, defines “state land” to include the seabed and subsoil which forms part of the continental shelf by virtue of an Order made by the British Queen while Sarawak was still a Colony. “Article 73(b) of the Federal Constitution states that the state legislature may make laws for the whole or any part of the State. “Therefore, state laws like the Land Code, the Oil Mining Ordinance 1958 of Sarawak apply to the seabed and sub-soils in the continental shelf regardless of the character of the high seas above that area of the continental shelf....Adenan also said the state government does not agree to the extension of Continental Shelf Act and the Petroleum Mining Act to Sarawak, which purports to authorise the federal government to grant licences for the exploration and mining of petroleum in the Continental Shelf of Sarawak. “Therefore, Parliament has no constitutional authority to pass any legislation relating to the issuance of licences for the prospecting for oil or the oil mining leases within the boundaries of Sarawak which extend to the seabed and sub-soils in the Continental Shelf,” he added. - See more at: http://m.themalaymailonline.com/malaysia/article/sarawak-seeks-to-regulate-petronas-activities-within-state#sthash.DjzxLOl4.PfWk3WCC.dpuf

Petronas Bintulu LNG Complex, located approximately 20km from Bintulu Town, covers 276ha and currently accounts for 40.5% of Sarawak's gross export, 6% of Malaysia's total export and 4.2% of the country's GDP. It includes three LNG plants with eight LNG trains in total. The three plants are respectively owned and operated by Malaysia LNG, MLNG Dua and MLNG Tiga, in joint venture with Petronas. http://www.hydrocarbons-technology.com/projects/petronas-bintulu-lng-complex-sarawak/

First edition of the Offshore Malaysia Oil and Gas Activity Map to 2019

http://www.infield.com/news/offshore-malaysia-oil-gas-activity-map/77

http://www.slideshare.net/innovasjonnorge/2013-opportunities-og-sea-egil

Malaysia Oil and Gas Profile - » A Barrel Full Oil & Gas Wiki http://abarrelfull.wikidot.com/malaysia-oil-and-gas-profile

26 May 2016: Panama Canal upgrade to bring more gas to Asia

Panama Canal Fever Sweeps Globe Again as New Era in Trade Nears by Alex Nussbaum Naureen Malik May 25, 2016... As U.S. gas exports ramp up, new route will slash time to Asia. $5 billion project also shifts oil, crops, container trade....

http://www.bloomberg.com/news/articles/2016-05-25/panama-canal-fever-sweeps-globe-again-as-new-era-in-trade-nears?cmpid=BBD052516_BIZ&utm_medium=email&utm_source=newsletter&utm_campaign=

24 May 2016: Russian state oil firm may buy Petronas' assets, its earnings and assets impaired on lower oil prices, Canada project news and others

Russian state oil firm may buy Petronas' assets Published 23 May 2016 ..."Also, Zarubezhneft shows interest in studying the assets of Petronas. The parties are holding consultations about it," he is reported as saying on Friday by Russian news agency Tass. "As for Zarubezhneft, it is studying opportunities to undertake projects in Malaysia.... https://www.malaysiakini.com/news/342610

Malaysia’s Petronas Says Oil Prices to Continue Affect Earnings - National company posts 60% annual decline in profit By YANTOULTRA NGUI May 18, 2016 http://www.wsj.com/articles/malaysias-petronas-says-oil-prices-to-continue-affect-earnings-1463583213

Petronas’ Q1 profit down 60% on low product prices, asset impairment Posted on 19 May 2016 http://www.thesundaily.my/news/1807242

Petronas and ringgit volatility 21 May 2016 http://www.thestar.com.my/business/business-news/2016/05/21/petronas-and-ringgit-volatility-taking-on-a-challenge-king-koil-acquisition/

Petronas leaves May crude price factor unchanged at $4/bbl May 12, 2016 http://af.reuters.com/article/energyOilNews/idAFL3N1891BK

Others

PETRONAS' PLNG SATU Heads to Malaysia's Kanowit Gas Field Off Sarawak by Petroliam Nasional Berhad|Press Release|Wednesday, May 18 - See more at: http://www.rigzone.com/news/oil_gas/a/144575/PETRONAS_PLNG_SATU_Heads_to_Malaysias_Kanowit_Gas_Field_Off_Sarawak#sthash.Vhthum8U.dpuf

Petronas sails Satu PFLNG Anamaria Deduleasa 16 May 2016 http://www.upstreamonline.com/incoming/1432691/petronas-sails-satu-pflng

Petronas Turns to Jotun to Help "Substantially Cut Fuel Costs" May 18, 2016 http://shipandbunker.com/news/apac/291637-petronas-turns-to-jotun-to-help-substantially-cut-fuel-costs

Petronas, PetroVietnam extend contract for 10 more years 11/05/2016 http://english.vietnamnet.vn/fms/business/156327/petronas--petrovietnam-extend-contract-for-10-more-years.html

Petronas, PetroVietnam extend PSC for 10 more years 9 May 2016 http://www.thestar.com.my/business/business-news/2016/05/09/petronas-petrovietnam-extend-psc-for-10-more-years/

PETRONAS, PetroVietnam Extend PM3CAA PSC in Malaysia-Vietnam Waters to 2027 by Petroliam Nasional Berhad / Vietnam Oil & Gas Group|Press Release|Tuesday, May 10 - See more at: http://www.rigzone.com/news/oil_gas/a/144395/PETRONAS_PetroVietnam_Extend_PM3CAA_PSC_in_MalaysiaVietnam_Waters_to_2027#sthash.OYe2BGUD.dpuf

Petronas to conduct test at Bintulu plant 12 May 2016 http://www.thestar.com.my/metro/community/2016/05/12/petronas-to-conduct-test-at-bintulu-plant/

DNeX bags drilling equipment and services job from Petronas Carigali By Supriya Surendran / theedgemarkets.com | May 19, 2016 http://www.theedgemarkets.com/my/article/dnex-bags-drilling-equipment-and-services-job-petronas-carigali

On Canada project

Canada Set to Make Petronas LNG Decision as Early as Mid-Summer May 2, 2016 http://boereport.com/2016/05/02/canada-set-to-make-petronas-lng-decision-as-early-as-mid-summer/

Petronas names new president of Pacific NorthWest LNG BRENT JANG VANCOUVER — The Globe and Mail Published Apr. 29 http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/petronas-names-new-head-at-pacific-northwest-lng-to-oversee-bc-project/article29791565/

B.C. LNG: First Nations appeal to UN to help stop Petronas project - Scientists have raised concerns about the project slated for Lelu Island The Canadian Press Posted: May 12, 2016 http://www.cbc.ca/news/canada/british-columbia/b-c-lng-first-nations-appeal-to-un-to-help-stop-petronas-project-1.3579074

On RAPID project

PETRONAS Signs Contracts For Pengerang Petrochemical Plants May 11 http://www.bernama.com.my/bernama/v8/newsindex.php?id=1244624

AP: Malaysia – Petronas seeking new RAPID partner 13 May 2016 http://www.pfie.com/ap-malaysia-petronas-seeking-new-rapid-partner/21247242.article

On Petronas Gas

Get set for competitive prices thanks to Gas Supply Bill 2016 BY FERNANDO FONG - 23 MAY 2016 Read More : http://www.nst.com.my/news/2016/05/147384/get-set-competitive-prices-thanks-gas-supply-bill-2016

Petronas Gas sets RM4.5bil capital expenditure over five years 27 April 2016 http://www.thestar.com.my/business/business-news/2016/04/27/petgas-sets-rm45bil-capex-over-five-years/

Petronas Gas set aside RM4.5b capex over next 5 years 26 April 2016 http://www.thesundaily.my/news/1779161

On MISC

Profit up at Petronas unit, weak tanker price clouds prospects May 9, 2016 http://asia.nikkei.com/Business/Companies/Profit-up-at-Petronas-unit-weak-tanker-price-clouds-prospects

Petronas unit to buy remainder 50% in joint venture to boost tanker fleet in International Shipping News 26/04/2016 http://www.hellenicshippingnews.com/petronas-unit-to-buy-remainder-50-in-joint-venture-to-boost-tanker-fleet/

15 Apr 2016: Petronas to slash capex for Canadian LNG project - to US$500 million over the next 2 years from the initial US$5 billion planned over the next 3 years

Petronas to slash capex for Canadian LNG project - report By Meena Lakshana / theedgemarkets.com | April 14, 2016 KUALA LUMPUR (April 14): National oil firm Petroliam National Bhd's (Petronas) unit Progress Energy Ltd is significantly slashing its capital expenditure (capex) in the US$36 billion Pacific Northwest liquefied natural gas (LNG) project in northern British Columbia while awaiting a final approval from the Canadian government's environmental agency. According to a report by Canada-based Financial Post, Progress president and chief executive officer Michael Culbert said the company is reducing its investment to US$500 million over the next two years from the initial US$5 billion planned over the next three years.

Petronas slashes spending as it awaits decision on B.C. liquefied natural gas project by Yadullah Hussain | April 13, 2016 http://business.financialpost.com/news/energy/petronas-slashes-spending-as-it-awaits-decision-on-b-c-liquefied-natural-gas-project?__lsa=924a-f026

13 Mar 2016: Petronas keeping eye on Candada project EIA process, Mahathir fired as Adviser to Petronas

Petronas keeping a close eye on Canada’s environmental impact assessment process By Dispatch Staff - March 12, 2016, Just when Petronas, through its subsidiary Pacific NorthWest LNG, and its partners were in the final stages of an investment decision, the new federal Liberal government in Canada is toughening up environmental reviews of major energy projects. This is a step in the direction of regaining “public trust” and to meet with the emission reduction pledge that the government made at the Paris conference last year. The government said in January that major energy projects would be subject to additional assessment on “direct and upstream greenhouse gas emissions” and this is something that spells uncertainty over the $36 billion LNG project says Petronas. Malaysia’s state-owned company has already spent an estimated $12 billion to get its LNG project to this stage and with new assessment, the project which has already suffered from multiple delays, will get delayed again and because of this Petronas has conveyed to federal cabinet ministers it won’t accept additional hurdles.... http://www.dispatchtribunal.com/petronas-keeping-a-close-eye-on-canadas-environmental-impact-assessment-process/17617/

Petronas to mature Canadian project BY TEE LIN SAY 10 March 2016; PETALING JAYA: Petroliam Nasional Bhd (Petronas) via subsidiary Pacific NorthWest LNG (PNW LNG) is proactively taking steps to mature the US$36bil (RM147bil) Pacific NorthWest liquefied natural gas (LNG) project in Canada towards its final investment decision, the national oil company said in a statement. This was in response to recent press reports which said that Petronas was close to pulling out of the project, following frustrations with the stance of Prime Minister Justin Trudeau’s climate-change priorities and the introduction of new uncertainties for the project. The new federal Liberal government in Canada is toughening up environmental reviews of major energy projects as it strives to meet international commitments to reduce greenhouse gas emissions.... A Canadian newspaper had quoted sources as saying that Petronas was threatening to walk away if it didn’t get federal approval by March 31.... http://www.thestar.com.my/business/business-news/2016/03/10/petronas-to-mature-canadian-project/

Malaysia Fires Former Leader Mahathir as Adviser to Petronas - Government cites former prime minister’s alliance with the opposition By YANTOULTRA NGUI March 11, 2016 KUALA LUMPUR, Malaysia—Former leader Mahathir Mohamad was terminated on Friday as an adviser to state oil firm Petroliam Nasional Bhd., or Petronas, over his alliance with the opposition, which is demanding the resignation of embattled Prime Minister Najib Razak. The prime minister’s office said in a statement that Mr. Najib’s cabinet has agreed unanimously to terminate Dr. Mahathir’s service... http://www.wsj.com/articles/malaysia-fires-former-leader-mahathir-as-adviser-to-petronas-1457707460

Mahathir Mohamad wins jailed Anwar Ibrahim's backing in bit to oust Malaysian PM Najib Razak March 4, 2016 by Lindsay Murdoch Bangkok: Malaysia's jailed opposition leader Anwar Ibrahim has declared support for his arch-nemesis Mahathir Mohamad in efforts to topple embattled Prime Minister Najib Razak. Mr Anwar said Mr Najib has "wreaked havoc" in the country with "the most severe scandal" in Malaysia's history... Former Malaysian prime minister Mahathir Mohamad in his office in Kuala Lumpur last week....

Former Malaysian prime minister Mahathir Mohamad in his office in Kuala Lumpur last week. Photo: Bloomberg... http://www.smh.com.au/world/mahathir-mohamad-wins-jailed-anwar-ibrahims-backing-in-bit-to-oust-malaysian-pm-najib-razak-20160303-gnabf8.html#ixzz42nKqYZzu

2 Mar 2016: Petronas to cut 1,000 jobs or less than 2%, expenditure cut of up to RM20 billion in 2016 to affect raft of Malaysia O&G players

The Edge reports: 1,000 job cuts affects less than 2% of the Petronas work force. It has over 50,000 staff at end 2014, up from 39,000 in 2009. Staff costs were almost RM10 billion at end 2014,average cost per employee was RM188,000. Key positions also shift as CEO Wan Zulkiflee appoints new upstream and technology & engineering heads.

source: screen shot of The Edge article, http://tefd.theedgemarkets.com/2016/TEP/20160302zgy9pl.pdf

3 Feb 2016: ExxonMobil sees 2015 earnings fall 50%, cuts 2016 spending by 25%

ExxonMobil sees 2015 earnings fall 50%, cuts 2016 spending by 25%; ExxonMobil Corp. plans to reduce its capital and exploration expenditures in 2016 by 25% compared with that of 2015 to $23.2 billion. The company estimates earnings in 2015 totaled $16.2 billion, a 50% drop from the $32.5 billion earned in 2014. Capital and exploration expenditures were $31.1 billion, down 19% from the 2014 level.

http://www.ogj.com/articles/2016/02/exxonmobil-sees-2015-earnings-fall-50-cuts-2016-spending-by-25.html?

http://www.ogj.com/articles/2016/02/exxonmobil-sees-2015-earnings-fall-50-cuts-2016-spending-by-25.html?

26 Jan 2016: Petronas, Pertamina, PTT, ONGC retain sovereign ratings while S&P downgrades others including Sinopec and CNOOC

S&P downgrades Asia Pacific energy firms, Petronas not affected 26 January 2016; We don't believe China's national oil companies will be able to stabilise their cash flow adequacy amid the current price environment, despite their efforts to cut capital expenditure and costs," the agency said. The company said it had therefore lowered its credit profile for companies, including China Petroleum & Chemical Corp and China National Offshore Oil Corp (CNOOC) in China and for Woodside Petroleum and Santos in Australia. However, S&P said the revised oil price outlook had no impact on the ratings and outlooks on national oil companies in South and Southeast Asia, such as Indonesia's PT Pertamina, Malaysia's Petroliam Nasional (Petronas), Thailand's PTT Public or India's Oil and Natural Gas Corp (ONGC). "The companies all have an important policy role as major energy suppliers and providers in their respective countries... Therefore, the ratings and outlook on these four companies remain the same as those on their respective sovereigns." The Standard & Poor's reviews come days after competing rating agency Moody's put 175 commodity firms, including in Asia, on review over a bleak outlook - See more at: http://www.themalaysianinsider.com/malaysia/article/sp-downgrades-asia-pacific-energy-firms-petronas-not-affected#sthash.NHfnbGms.dpuf

12 Jan 2016: Bloomberg - Petronas Sees Three More Tough Years in `Unsettling Environment,' mulls $30 oil for 2016 (two months ago, assumed $48 for 2016)

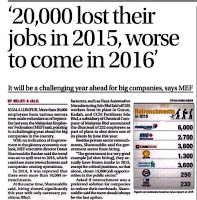

Note: This is a still not a major Petronas news update, but an ad hoc one.- Petronas also in recent Malaysia news alerts on cuts to contract workers in 2016. Shell Malaysia reported in local news to have cut about 1,300 jobs in 2015. Jobs loss outlook for 2016 worse than some 20,000 lost in 2015 in Malaysia. Other 2015 job cuts include Malaysia Airlines -6,000, RHB Bank -2,700, CIMB Bank -3,600, Standard Chartered -3,600 from The Malaysian Insider compilation from 2015 news.

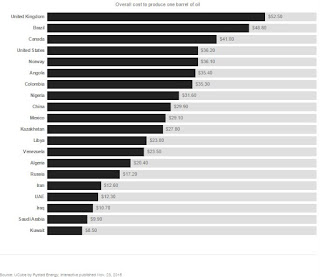

- The recent price drop from around $38 toward $31 may highlight these major producers by cost: United States $36.20, Norway $36.10, Angola $35.40, Colombia $35.30, Nigeria$31.60. See diagram below.

- Certainly also issues for POGO food-fuel price spread re. biodiesel.

- China GDP and oil demand is eyed, and into the future, car makers start to worry about tech disruption to their industry.

Source: What it costs to produce oil By Alanna Petroff and Tal Yellin / CNNMoney - The collapse in the price of oil has squeezed energy companies and countries that were betting on higher returns. Here’s what it costs on average to pump a barrel of oil in the 20 biggest oil producing nations. http://money.cnn.com/interactive/economy/the-cost-to-produce-a-barrel-of-oil/index.html?iid=EL.

Oil tumbles nearly 5 percent to new lows; analysts warn of $20s - A brutal new year selloff in oil markets deepened on Monday, with prices plunging as much as 5 percent to new 12-year lows as further ructions in the Chinese stock market threatened to knock crude into the $20s. http://uk.reuters.com/article/idUKKCN0UP01T20160111

Petronas Sees Three More Tough Years in `Unsettling Environment' by Elffie Chew January 12, 2016; Crude oil may average $30/barrel in low-price scenario. Company plans to keep 60-70 billion ringgit annual capex.... Petroliam Nasional Bhd. said crude prices could average $30 a barrel this year and warned the Malaysian state oil company faces two to three tough years.Just two months after the company was assuming an average price of $48 a barrel, Chief Executive Officer Wan Zulkiflee Wan Ariffin laid out the new "low-price" scenario for 2016. Petronas remains committed to its multi-billion dollar projects as it sticks to its capital expenditure plan of as much as 350 billion ringgit ($80 billion) over the next five years, he said Monday.... The drop in oil has in part led to international investors souring on Malaysia, with the ringgit slumping to a 17-year low in 2015. The net-oil exporting nation stands to lose 300 million ringgit for every $1 a barrel decline in crude, according to government estimates. Brent currently trades below $32 a barrel.Moody Investors Service lowered its credit-rating outlook for Malaysia on Monday, citing an external environment that has crimped government revenue despite Prime Minister Najib Razak’s efforts to improve the country’s finances. Najib said last week he will amendthe 2016 budget to take into account the lower price of oil after using the same price assumption that Petronas did....."The reversal in the price will happen," Wan Zulkiflee said. "It’s only whether it will happen in three years, five years or in seven years’ time.".... The slowing Chinese economy and its weakening yuan are having an impact on Petronas’ sales and operations in the North Asian nation, Wan Zulkiflee said.....In Canada, Petronas is still awaiting environmental approval from regulators to start construction on the Pacific NorthWest LNG project....The company will review its decision within this quarter on whether to proceed .... Wan Zulkiflee said the company will continue to maintain its production levels as significant cuts would result in setbacks when there is a recovery. Petronas hasn’t gotten to the point where it needs to "right-size" permanent employees even as it reviews the status of contract workers, he said. .....Spending Cuts - It’s also lowering spending by improving on procurement processes and cutting costs on business travel that saved the company 24 percent in operating expenditure excluding salaries last year, Wan Zulkiflee said....... It’s still committed to paying the government 16 billion ringgit in dividends this year, down from 26 billion ringgit in 2015... http://www.bloomberg.com/news/articles/2016-01-11/petronas-sees-three-more-tough-years-in-unsettling-environment-

Oil Extends Losses From 12-Year Low as Stockpiles Seen Expanding by Ben Sharples January 12, 2016, Inventories probably rose 2 million barrels last week: survey, Iran to starting selling new oil grade before boosting exports... http://www.bloomberg.com/news/articles/2016-01-11/oil-extends-decline-from-12-year-low-as-stockpiles-seen-rising

China's Demand for Crude is Showing Signs of Cracking - Resilient supply isn't the only problem for crude. by Luke Kawa, January 11, 2016; http://www.bloomberg.com/news/articles/2016-01-11/china-s-demand-for-crude-is-showing-signs-of-cracking

The End of the Monetary Illusion Magnifies Shocks for Markets by Simon Kennedy January 8, 2016; Central banks no longer have as much room to deliver stimulus. HSBC says currencies most sensitive to policy in 15 years... Central bankers are no longer the circuit breakers for financial markets. Monetary-policy makers, market saviors the past decade through the promise of interest-rate reductions or asset purchases, now lack the space to cut further -- if at all -- or buy more. Even those willing to intensify their efforts increasingly doubt the potency of such policies. That’s leaving investors having to cope alone with shocks such as this week’s rout in China or when economic data disappoint, magnifying the impact of such events....http://www.bloomberg.com/news/articles/2016-01-08/the-end-of-the-monetary-illusion-magnifies-shocks-for-markets

The driverless, car-sharing road ahead - Carmakers increasingly fret that their industry is on the brink of huge disruption Jan 9th 2016; ...Now, Mr Fields is talking about autonomous cars being ready to roll by 2020. More conservative car bosses add five years.... Barclays, another bank, forecasts that the fully driverless vehicle will result in the average American household cutting its car ownership from 2.1 vehicles now to 1.2 by 2040.... The 11m or so annual sales of mass-market cars for personal ownership in America may be replaced by 3.8m sales of self-driving cars, either personally owned or part of taxi fleets, Barclays thinks....http://www.economist.com/news/business/21685459-carmakers-increasingly-fret-their-industry-brink-huge-disruption?cid1=cust/noenew/n/n/n/20160111n/owned/n/n/nwl/n/n/n/email

4 Jan 2016: Pressure to cut domestic O&G jobs after expatriates sent packing? Big oil to cut investment again in 2016.

Editor's note: Over the weekend, chatted with some O&G people who report that PETRONAS under pressure from its foreign creditors on why it is not cutting more domestic jobs. O&G expatriate job cuts already impacting the KL rental property markets. **This is a short update only, I shall do a major PETRONAS news review for 14 Nov to end December soon.Big oil to cut investment again in 2016 By Karolin Schaps and Ron Bousso Jan 3, 2016; At around $37 a barrel, crude prices are well below the $60 firms such as Total (TOTF.PA), Statoil STO.OL and BP (BP.L) need to balance their books, a level that has already been sharply reduced over the past 18 months. International oil companies are once again being forced to cut spending, sell assets, shed jobs and delay projects as the oil slump shows no sign of recovery. U.S. producers Chevron (CVX.N) and ConocoPhillips (COP.N) have published plans to slash their 2016 budgets by a quarter. Royal Dutch Shell (RDSa.L) has also announced a further $5 billion in spending cuts if its planned takeover of BG Group (BG.L) goes ahead. http://uk.reuters.com/article/uk-oil-companies-investments-idUKKBN0UH0AG20160103

14 December 2015, from The Edge Malaysia on loss of jobs by O&G expatriates impacting KL high-end property rentals.

14 Nov 2015: PETRONAS 3Q2015 net profit plunges, capex plans continue, dividend cut, Canada project hurdles, RAPID on track

Petronas Q3 net profit tumbles 91% on weak oil prices Published: 11 November 2015 http://www.themalaysianinsider.com/business/article/petronas-q3-net-profit-tumbles-91-on-weak-oil-prices#sthash.CA7S0JwR.dpufPetronas slashes 2016 dividend as earnings plummet Published: 12 November 2015 http://www.themalaysianinsider.com/business/article/petronas-slashes-2016-dividend-as-earnings-plummet#sthash.ExUzppFO.dpuf

Malaysia's Petronas says committed to capex plans despite continuing challenges (Platts)-- 12 Nov 2015 * January-September capex up 5.5% on year at $11.42 billion * Q3 oil, gas production rises 4.8% on year * Progress of RAPID project on track Malaysia's state-owned Petronas remained committed to its capital expenditure plans even though it anticipated continuing challenges due to bearish market sentiment, CEO Wan Zulkiflee Wan Ariffin said Wednesday. The projects that the company will focus its capital investment on include the Refinery And Petrochemical Integrated Development project in the southern Johor state; the Pacific North West LNG Project in Canada; LNG Train 9 in Bintulu; and the two floating LNG projects being constructed in South Korea. "These capex projects are investments for the long term, and we are set on seeing them through successfully to ensure Petronas' sustainability well into the future," Wan Zulkiflee said in a statement while announcing the company's Q3 2015 results. http://www.platts.com/latest-news/natural-gas/singapore/malaysias-petronas-says-committed-to-capex-plans-26275638

Government will not revise Budget 2016 despite Petronas’ lower dividend, says deputy finance minister Friday November 13, 2015 - See more at: http://www.themalaymailonline.com/malaysia/article/government-will-not-revise-budget-2016-despite-petronas-lower-dividend-says#sthash.jiRcOwDD.dpuf

PETRONAS Not Laying Off Permanent Staff Despite Current Market Gloom by Chee Yew Cheang Rigzone Staff Thursday, November 12, 2015- See more at: http://www.rigzone.com/news/oil_gas/a/141580/PETRONAS_Not_Laying_Off_Permanent_Staff_Despite_Current_Market_Gloom#sthash.lu12aOx0.dpuf

Canadian indigenous, environmental groups urge Trudeau to reject Petronas project Published: 12 November 2015 http://www.themalaysianinsider.com/malaysia/article/canadian-indigenous-environmental-groups-urge-trudeau-to-reject-petronas-pr#sthash.KyvnVLWa.dpuf

Another hurdle to Petronas’ project in Canada 11 November 2015; Over 70 Northern British Columbia indigenous leaders, environmental organisations, scientists, businesses, unions, university groups, and faith groups from across the province have signed on to a letter written by Lax Kw’alaams hereditary chief Yahaan (Donnie Wesley) calling on Prime Minister Justin Trudeau and Environment Minister Catherine McKenna to reject the PNW LNG plant proposed for Lelu Island and Flora Bank. They also want ongoing test-drilling at the site to be cancelled. The final Canadian Environmental Assessment Agency (CEAA) decision, expected by early 2016 though possibly sooner, is the final major regulatory hurdle the project must overcome to move ahead. http://www.thestar.com.my/Business/Business-News/2015/11/11/Another-hurdle-to-Petronas-project-in-Canada/?style=biz

PETRONAS Celebrates First Production at Bukit Tua, Kepodang Fields by Petroliam Nasional Berhad Press Release November 05, 2015 http://www.rigzone.com/news/oil_gas/a/141450/PETRONAS_Celebrates_First_Production_at_Bukit_Tua_Kepodang_Fields#sthash.56HKH1ex.dpuf

Petronas Unit Allocates Up to $300m for Indonesian Oil Fields Next Year By : Retno Ayuningtyas November 09, 2015; A unit of Malaysian energy giant Petronas plans to invest $200 million to $300 million next year on developing its oil blocks in Indonesia, an executive says. Hazli Sham Kassim, Petronas Carigali’s general manager and head of Indonesian operations, said the company would wrap up production at the Bukit Tua field in Ketapang, East Java, and begin exploration activities in the North Madura II block in offshore East Java in 2016. http://jakartaglobe.beritasatu.com/business/petronas-unit-allocates-300m-indonesian-oil-fields-next-year/

OMV, Petronas launch oil talks with Iran TEHRAN, Nov. 11 (MNA) – Describing the latest status of negotiations with Malaysia’s Petronas and Austria’s OMV oil companies, managing director of ICOFC announced several Russian firms’ willingness to invest in Iran’s central oil fields. http://en.mehrnews.com/news/111869/OMV-Petronas-launch-oil-talks-with-Iran

PETRONAS FLNG2 Reaches Milestone with Keel Laying at SHI's Shipyard by Petroliam Nasional Berhad Press Release Monday, November 09, 20- See more at: http://www.rigzone.com/news/oil_gas/a/141503/PETRONAS_FLNG2_Reaches_Milestone_with_Keel_Laying_at_SHIs_Shipyard#sthash.xyqjLvVH.dpuf

Petronas floating LNG2 to commission in 2018 Posted on 9 November 2015 http://www.thesundaily.my/news/1606223

WCT bags RM315.6 million Petronas EPCC job Posted on 13 November 2015 -http://www.thesundaily.my/news/1609929

Petronas Dagangan aims to sustain financial results 9 November 2015 http://www.thestar.com.my/Business/Business-News/2015/11/09/Petronas-Dagangan-aims-to-sustain-financial-results/?style=biz

Total, Petronas keep eye out for acquisitions as prices pressure oil players October 18, 2015 http://www.smh.com.au/business/energy/total-petronas-keep-eye-out-for-acquisitions-as-prices-pressure-oil-players-20151017-gkbu4o.html#ixzz3rO6CuZ9j

Icon Offshore appoints Petronas top exec Amir as new MD 3 November 2015 http://www.thestar.com.my/Business/Business-News/2015/11/03/Icon-appoints-Petronas-top-exec-Amir-as-new-MD/?style=biz

MISC-Bumi Armada FPSO business merger could create huge Petronas subsidary by By Vincent Wee Malaysian shipping company MISC and oil and gas services provider Bumi Armada, both relatively big players in their respective fields, are reportedly in early stages of exploring a corporate exercise involving the consolidation of the floating production storage offshore (FPSO) businesses of both companies, local reports cited sources as saying. According to them, the exercise could see MISC inject its FPSO businesses into Bumi Armada in return for shares, a move that could see Petronas' shipping unit ending up with a big stake in Bumi Armada http://www.seatrade-maritime.com/news/asia/misc-bumi-armada-fpso-business-merger-could-create-huge-petronas-subsidary.html

Lawas natives yet to see a single sen over Petronas gas pipeline BY SHERIDAN MAHAVERA 29 October 2015, Lun Bawang landowners in Kampung Long Luping said they have either been partially paid or not at all for land taken for the pipeline, which made the news last year after a section of it blew up. Sakai Libang, 54, said the problem was not Petronas but the Land and Survey Department http://www.themalaysianinsider.com/malaysia/article/lawas-natives-yet-to-see-a-single-sen-over-petronas-gas-pipeline#sthash.6jD8YEjH.dpuf

11 October 2015: Petronas mostly ‘exempted’ from TPP, quit Mauritania, mulling TAP Project, analysts doubt Canada project, credit and rating

Khazanah, Petronas mostly ‘exempted’ from TPP, says minister Published: 7 October 2015 8:56 PM - See more at: http://www.themalaysianinsider.com/malaysia/article/malaysia-state-fund-petronas-mostly-exempted-from-tpp-says-minister#sthash.pZ9XE5yZ.dpuf

Petronas Renews Pledge to Export Canadian Gas as Analysts Doubt by Rebecca Penty October 9, 2015 — 7:24 AM HKT. Malaysian energy company says proceeding depends on approvals. Executive vice president dismisses energy market volatility.... Analysts have cast doubt on Canada’s ability to deliver LNG export projects this decade. The global market is entering a period of oversupply, with ventures starting up in Australia and the U.S., and demand is slowing in Asia just as the oil slump has taken down prices for LNG. There are 20 projects under consideration for export from the Pacific Coast in British Columbia and none have started construction.... Canada and East Africa are “last to the LNG party” globally behind the U.S. and Australia, according to CIBC World Markets commodities strategist Katherine Spector. Plunging oil prices mean only about 6 billion cubic feet (170 million cubic meters) a day of LNG exports will be developed in North America by 2022, Spector wrote in a report this week, about half the amount she had forecast last year would be online by 2020.... Petronas in June said it would proceed with the Pacific NorthWest LNG project, pending outstanding approvals, becoming the only Canadian proposal to issue an investment decision to date. Other owners of the venture are Indian Oil Corp., Japan Petroleum Exploration Co., China Petroleum & Chemical Corp. and Brunei National Petroleum Co.

http://www.bloomberg.com/news/articles/2015-10-08/petronas-renews-pledge-to-export-canadian-gas-as-analysts-doubt

Petronas quitting Mauritania on revenue, oil price fall Published: 7 October 2015 4:06 PM - See more at: http://www.themalaysianinsider.com/business/article/petronas-quitting-mauritania-on-revenue-oil-price-fall#sthash.DqlwsV0S.dpuf

Petronas Said to Mull Buying Statoil’s Stake in TAP Project by Ercan Ersoy and Elffie Chew September 2, 2015 — 1:16 AM HKTUpdated on September 2, 2015 — 8:28 PM HKT http://www.bloomberg.com/news/articles/2015-09-01/petronas-said-to-consider-buying-statoil-s-stake-in-tap-project

Adding on older news items of interest

UPDATE 1-Malaysia's Petronas to delay RAPID'S refinery start-up to mid-2019 May 18, 2015, * Weak commodity prices prompt review, re-bidding of EPC contracts * Petrochemical chains also rephased due to weak oil prices... http://www.reuters.com/article/2015/05/18/asia-oil-petronas-idUSL3N0Y924T20150518

The Yuan Drop Just Added $14 Billion to Asia Inc.’s Debt Burden by Christopher Langner, David Yong and Lianting Tu August 13, 2015 — 2:43 PM HKT; ... The extra yield over Treasuries investors demand to hold the 10-year 5.25 percent dollar bonds of state-owned oil company Petroliam Nasional Bhd. -- among Malaysia’s most liquid notes -- has risen 11 basis points this week to the highest since March. “We’re especially worried about Malaysia as its currency faces the most stress after the yuan devaluation,” said Gordon Tsui, the head of fixed income at Taikang Asset Management (Hong Kong) Co

ASIA CREDIT CLOSE: Petronas takes advantage of improving risk appetite HONG KONG, Aug 5 (IFR) - Petronas saw its bonds tighten as an improvement in risk appetite drove investors to buy into the long-end of the curve. The Petronas 2025s and 2045s tightened around 5bp, according to a Hong Kong-based trader, who put it down to investors taking advantage of an overnight rise in 10-year US Treasury yields.... http://www.reuters.com/article/2015/08/05/markets-asia-debt-idUSL3N10G3AD20150805

Fitch Revises PETRONAS' Outlook to Stable; Affirms 'A' IDR Jul 1, 2015 2:38am EDT http://www.reuters.com/article/2015/07/01/idUSFit92745720150701

British Columbia Sees $7.1 Billion From Petronas Gas Exports July 7, 2015 — 6:11 AM HKTUpdated on July 7, 2015 — 7:12 AM HKT British Columbia is pledging to cap levies on Petroliam Nasional Bhd.’s natural gas export project as it expects to collect C$9 billion ($7.1 billion) from the venture by 2030. Canada’s westernmost province must compensate the Malaysian oil producer, known as Petronas, and its partners if it adds costs through changes to certain taxes or credits over the next 25 years, according to terms of an agreement signed May 20 that were released Monday. “The revenue opportunities are significant,” British Columbia Finance Minister Michael de Jong said in a briefing with reporters Monday..... http://www.bloomberg.com/news/articles/2015-07-06/british-columbia-sees-7-1-billion-take-from-petronas-gas-export

We only produce the oil, Putrajaya sets price, says Petronas chairman Published: 2 July 2015 8:51 AM - See more at: http://www.themalaysianinsider.com/malaysia/article/we-only-produce-the-oil-putrajaya-sets-price-says-petronas-chairman#sthash.8DtLxS2L.dpuf

South Sudan Fighting Escalates in Oil States Before Peace Talks by Okech Francis June 6, 2015 — 10:46 PM HKT http://www.bloomberg.com/news/articles/2015-06-06/south-sudan-fighting-escalates-in-oil-states-before-peace-talks

South Sudan Oil Field Becomes Battleground as Economy Reels by Ilya Gridneff May 26, 2015 — 5:00 AM HKT http://www.bloomberg.com/news/articles/2015-05-25/south-sudan-oil-field-becomes-key-battleground-as-economy-reels

MMC Corp appoints former Petronas president Shamsul as chairman Published: 6 July 2015 7:42 PM - See more at: http://www.themalaysianinsider.com/business/article/mmc-corp-appoints-former-petronas-president-shamsul-as-chairman#sthash.M7lQbRD8.dpuf

19 August 2015: PETRONAS slashes rig count to 14 from 39 and operating cashflow woes requires use of cash reserves, Irish probe tanks, environmental doubts on BC LNG project, US starts talks on South Sudan sanctions

On recent earnings and rig count slash, worries of Malaysia contractors

- Petronas slashes rig count by more than two-thirds this year By Vincent Wee from Hong Kong Malaysian national oil company Petronas' results briefing last week confirmed the depressed state of the oil and gas market, with president and group ceo Wan Zulkiflee Wan Ariffin revealing a staggering drop in rig count to just 14 rigs expected to be in operation by the end of this year, from 39 at the same point last year, local media reported. The idling of over half of its oil rigs within a year a dramatic indicator of the downturn in the oil and gas industry and will have filter down effects throughout the supply chain for the many local contractors dependent on Petronas jobs.... http://www.seatrade-maritime.com/news/asia/petronas-slashes-rig-count-by-more-than-two-thirds-this-year.html

- Petronas warns of dwindling operating cash flow Posted on 17 August 2015 - 05:38am Lee Weng Khuen http://www.thesundaily.my/news/1521375

- Petronas lowers rig count Monday, 17 August 2015 By: RISEN JAYASEELAN http://www.thestar.com.my/Business/Business-News/2015/08/17/Petronas-lowers-rig-count/?style=biz

- UPDATE 1-Malaysia's Petronas says operations won't cover 2015 dividend, capex demands * Will need to draw on cash reserves, savings * Net profit down 47 pct on lower crude prices, sales * On track to pay government dividend (Adds CEO comments, context) http://www.reuters.com/article/2015/08/14/petronas-results-idUSL3N10P3IC20150814

- Enra Group cautious on O&G venture as Petronas warns of cashflow constraints Posted on 18 August 2015 - 01:08pm Lee Weng Khuen http://www.thesundaily.my/news/1523099

On BC project

- Malaysia scandal dampens hopes for Petronas LNG Project in BC published by Asianpost on Wed, 08/12/2015 - 08:56 By Ng Weng Hoong New Canadian Media Special to The Post British Columbia Finance Minister Mike de Jong’s recent visit to Malaysia yielded a Facebook photo-op with Prime Minister Najib Abdul Razak and a misreported story that state energy firm Petronas and its five Asian partners would begin construction of their US$36 billion liquefied natural gas (LNG) project in northern BC this September. In the reporting of de Jong’s press conference, Malaysian news agency Bernama did not make clear that the project must first receive Ottawa’s environmental approval, due sometime between September and December, before the Petronas-led Pacific NorthWest (PNW) LNG – not the British Columbia government – can make its final investment decision http://www.asianpacificpost.com/article/7085-malaysia-scandal-dampens-hopes-petronas-lng-project-bc.html

- Petronas LNG terminal set in salmon's 'Grand Central Station' - New data shows LNG terminal in middle of nursery for 40 salmon populations CBC News Posted: Aug 07, 2015 3:22 PM PT| Last Updated: Aug 08, 2015 2:13 PM PT http://www.cbc.ca/news/canada/british-columbia/petronas-lng-terminal-set-in-salmon-s-grand-central-station-1.3181203

On South Sudan

23 June 2015: PETRONAS C$36 billion gas project faces dissent and low prices, with several LNG startups oversupply / glut until 2020-2025, Axens to provide processing technology for naptha at PETRONAS RAPID, PSE Seven Heads agrees contract for Irish drilling

Petronas Canada Gas Bet No Cinch as Dissent Adds to Low Prices by Rebecca Pentyand Allison McNeely June 22, 2015 — 10:04 PM HKT; Petroliam Nasional Bhd.’s C$36 billion ($29.4 billion) Canadian natural gas export project was treading water after the global market for the fuel weakened. Now local opposition is adding a new hurdle. A British Columbia aboriginal group that claims title to land earmarked for the liquefied natural gas terminal says it will take legal action if its environmental concerns aren’t addressed. That follows a decision by Petronas, as the Malaysian company is known, and investors earlier this month to press ahead with the Pacific NorthWest LNG terminal. The Lax Kw’alaams band, which has already turned down C$1.15 billion in compensation, says the terminal is slated for a culturally significant island and would damage salmon habitat, Deputy Mayor Stan Dennis said in an interview. In October, then-Petronas Chief Executive Officer Shamsul Azhar Abbas said the project needs to stay on schedule and begin shipments in 2019 or face a deferral of 10 to 15 years, until another market window opens. “One of the key risks is potential for delay,” said Tom Isaac, a partner at Osler, Hoskin & Harcourt LLP in Calgary who leads the firm’s aboriginal law group and has no stake in the project. “If litigation were initiated, that could take some time to wind its way through the courts.” Several planned LNG project startups this decade means buyers will be oversupplied until at least 2020. About 40 percent of respondents to a recent Bloomberg Intelligence survey said the glut may last until 2025, analysts led by Elchin Mammadov said in a June 16 presentation. Australia and Canada have the most expensive LNG projects in the world to develop, and some will be shelved or canceled, the analysts said....

http://www.bloomberg.com/news/articles/2015-06-22/petronas-canada-gas-bet-no-cinch-as-dissent-adds-to-low-prices

Malaysia’s Petronas to Build Natural-Gas Plant in British Columbia - Plan paves the way for export of cheap North American gas to Asia, By Chester Dawson June 12, 2015 1:53 a.m. ET

CALGARY—Malaysia’s state-owned energy company Thursday said it would build a large-scale natural-gas plant on Canada’s Pacific coast, paving the way for the export of cheap North American gas to high-demand markets in Asia. The 36 billion-Canadian-dollar (US$29.3 billion) project, known as Pacific NorthWest LNG, marks Canada’s emergence as a hub for exporting surplus North American natural gas to Asia. It is the first of nearly two...

http://www.wsj.com/articles/malaysias-petronas-to-build-natural-gas-plant-in-british-columbia-1434088430

PETRONAS selects Axens Technologies for Malaysia’s RAPID project Monday, Jun 22, 2015

Petroliam Nasional Berhad (PETRONAS), Malaysia’s national oil and gas company has selected Axens as a technology provider for PETRONAS’ Refinery and Petrochemicals Integrated Development (RAPID) project located in Pengerang, Johor, Malaysia..... RAPID is estimated to cost US$16 billion while the associated facilities will involve an investment of about US$11 billion. PIC is poised for its refinery start-up by early 2019.... Axens was initially selected in October 2010 for a Detailed Feasibility Study, after which their technologies were selected following an open bid in January 2012 on the basis of the best NPV (Net Present Value), as well as proven long term operating experiences supported by the technology and catalyst’s specific features; hence providing additional benefits to the project. The following technologies from Axens was selected for the RAPID project:

•Naphtha Hydrotreating (NHT), this process purifies naphtha removing dienes, olefins compounds, sulfur and nitrogen species with a feed capacity of 21,000 BPSD; •OctanizingTM a continuous catalytic regenerative (CCR) reforming process for maximizing the production of reformate from heavy hydrotreated naphtha , with a feed capacity of this unit 14,000 BPSD.........

http://www.youroilandgasnews.com/petronas+selects+axens+technologies+for+malaysia%E2%80%99s+rapid+project_117941.html

Petronas inks rig for Irish drilling Written by Elaine Maslin Monday, 22 June 2015 03:59; Petronas subsidiary PSE Seven Heads has agreed a contract to drill on the Midleton prospect offshore Ireland starting in August, according to partner Lansdowne Oil & Gas. PSE Seven Heads, a subsidiary of Petronas' PSE Kinsale Energy will use Diamond Offshore Drilling's Ocean Guardian semisubmersible drilling rig to drill the well, in SEL 4/07, which covers part-blocks 49/11, 49/12, 49/17 and 49/18, immediately southeast of the Kinsale Head gas field, in the Celtic Sea offshore southeast Ireland. The Midleton prospect, about 20km northeast of the Kinsale Head field, has been estimated to contain 330 Bcf gas initially in place, according to Landsdowne.... http://www.oedigital.com/component/k2/item/9484-petronas-inks-rig-for-irish-drilling

10 June 2015: Opinion: Uncertainty grows over LNG deal - ‘Conditional’ final investment decision expected from Petronas by June; Tanjung Offshore secures RM250m contract from Petronas Carigali

Opinion: Uncertainty grows over LNG deal - ‘Conditional’ final investment decision expected from Petronas by June BY NG WENG HOONG, SPECIAL TO THE VANCOUVER SUN JUNE 5, 2015; The sobering reality is the project faces greater barriers and more uncertainties than a year ago when Zulkiflee’s predecessor, Shamsul Azhar Abbas, began to grasp the magnitude of his over-reach to develop natural gas reserves, pipelines and a large LNG terminal in B.C. all within five years. Company insiders confirmed they had underestimated the extent of environmental and First Nations opposition to fracking, and oil and gas pipeline projects in B.C. Also, like most in the industry, they had not anticipated the crippling effects of the oil price collapse. Political developments in Malaysia and China could add a few more black swans to halt the project’s progress.....Shamsul’s term was not renewed in March following clashes with his boss and PNW’s biggest supporter, Malaysian Prime Minister Najib Abdul Razak, who is now fighting for political survival over allegations of financial mismanagement of billions of dollars in state funds. It was Najib who announced the project’s massive $36-billion price tag, the equivalent of 10 per cent of Malaysia’s GDP, to a surprised Prime Minister Stephen Harper during a visit to Southeast Asia in 2013. Will Petronas or the Malaysian government continue to support PNW’s high-risk project if Najib is no longer prime minister?.........management. Zulkiflee made his first move by approving PNW’s offer to pay $1.15 billion to the 3,700-member Lax Kw’alaams First Nations group over 40 years for the right to build the LNG project over their property and ancient fishing grounds. Despite some calling it a generous “game changer,” the sum offered was insignificant as it amounts to less than $8,000 per person per year........“Industry analysts expect only one to three B.C. LNG projects to be operating by 2025. The market outlook for Asia is still uncertain,” she wrote. Also, Canadian projects, requiring the equivalent of crude oil prices at $76 to $90 US a barrel, are expensive when compared with their rivals in the U.S.... Another likely source of concern, not widely discussed, is the commitment of two of PNW’s cornerstone shareholders, Sinopec and IOC.... Amid the LNG price collapse, India is spoiled for choice to increase import volumes through existing channels with Qatar, Nigeria, Egypt and Australia while it pursues talks to develop new overland supply lines with Russia, Turkmenistan and even Iran, which could soon be free of trade sanctions imposed by the West. These developments are leaving Petronas looking increasingly quixotic in its quest to launch B.C.’s LNG industry. The company’s attempts to sell down its 62 per cent stake in PNW LNG to 50 per cent have stalled since the last deal was concluded with Sinopec in April 2014....Rather than clarify the situation, Petronas’ offer to make a conditional final investment decision could set the stage for further negotiations and uncertainty. http://www.vancouversun.com/opinion/op-ed/Opinion+Uncertainty+grows+over+deal/11112497/story.html

Tanjung Offshore secures RM250m contract from Petronas Carigali Tuesday, 9 June 2015

KUALA LUMPUR: Oil & gas services provider, Tanjung Offshore Bhd secured a RM250mil contract to provide topside maintenance to Petronas Carigali Sdn Bhd’s platforms in Sarawak.

It said on Tuesday the construction work request contract would involve the maintenance for Petronas Carigali’s offshore and onshore facilities in Sarawak. The contract is for two years with an option to extend for another year.... http://www.thestar.com.my/Business/Business-News/2015/06/09/Tanjung-Offshore-secures-RM250m-contract-from-Petronas-Carigali/?style=biz

1 June 2015: Petronas top official robbed of RM300,000 (c. USD 81,000) in house break-in

Petronas top official robbed of RM300,000 in house break-in Posted on 27 May 2015 - 09:21pm

KUALA LUMPUR: A gang of robbers escaped with more than RM300,000 in cash and valuables after holding up a top official of national petroleum company Petronas and his family at their bungalow near Taman Tun Abdul Razak, Ampang today.

The Petronas top official, who is a Datuk, was asleep when he and his family were woken up from their sleep by the robbers who broke in at about 5am.

The gang fled after getting cash, gold jewellery, luxury watches and other items.

Minutes after they left, the victims, who were unharmed, managed to untie themselves and alerted the police.

http://www.thesundaily.my/node/311694

22 May 2015: Malaysia's Petronas posts Q1 profit drop, cuts dividend; Petronas reports first oil from Indonesia's Bukit Tua field

UPDATE 1-Malaysia's Petronas posts Q1 profit drop, cuts dividend on oil price fall By Anuradha Raghu Fri May 22, 2015 6:59am EDT * Q1 net profit 11.4 bln rgt vs 18.8 bln rgt in Q1 2014 * Maintains projection for crude prices at avg $55/barrel in 2015 * Price will be rangebound for many, many quarters- CEO (Adds details of results, CEO quotes) KUALA LUMPUR, May 22 (Reuters) - Malaysian state-owned oil firm Petronas posted a 39 percent drop in first-quarter net profit on lower crude prices, but a mild rebound in oil helped earnings bounce from the previous quarter when it made its first quarterly loss in at last five years. Global oil prices have climbed more than 40 percent from six-year lows hit earlier this year to touch 2015 highs in early May. Prices, though, are still well-down from the peaks of June 2014, when growing evidence of a worldwide glut sent crude markets into free fall. Petroliam Nasional Bhd, which is called Petronas, reported on Friday a net profit of 11.4 billion ringgit ($3.18 billion) for the January-March period, compared to a profit of 18.8 billion ringgit in the same period in 2014. It had suffered a net loss of 7.3 billion ringgit ($2.03 billion) in the previous quarter. Malaysia, a net energy exporter, relies heavily on Petronas for most of its oil and gas revenue. Out of the 66 billion ringgit of oil revenues in 2014, 29 billion came in the form of dividends paid by Petronas, a government report showed. That dividend would be cut to 26 billion ringgit in 2015, Petronas said..... http://www.reuters.com/article/2015/05/22/petronas-results-idUSL3N0YC3QY20150522

Petronas reports first oil from Indonesia's Bukit Tua field WorldOil (subscription) KUALA LUMPUR, Malaysia -- Petronas has reached a significant milestone in its upstream operations in Indonesia with first oil achieved from Bukit Tua field on May 17. “This upstream project is an integrated development as it also involves the ...

http://www.worldoil.com/news/2015/5/22/petronas-reports-first-oil-from-indonesia-s-bukit-tua-field

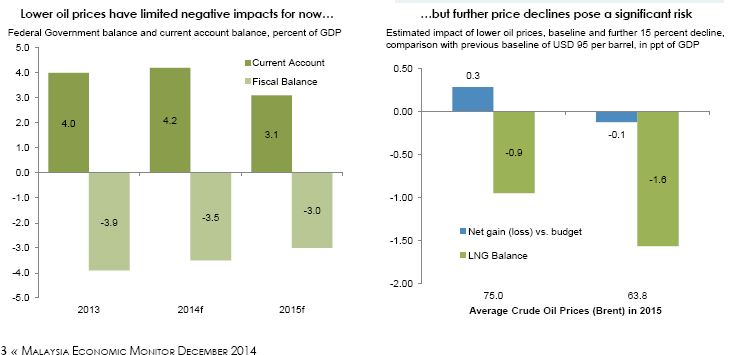

18 May 2015: LNG's adverse impact on Petronas and Malaysia - Citigroup cited in The Star; PETRONAS suggests that Malaysia's many O&G players should consolidate

LNG's adverse impact on Petronas and Malaysia Monday, 18 May 2015 By: TEE LIN SAY PETALING JAYA: The earnings of state-owned Petroliam Nasional Bhd (Petronas) and the country’s current account are expected to come under pressure in the next few months due to the steep drop in the average price of spot liquefied natural gas (LNG). LNG prices track crude oil prices and have more than halved, with the average spot price down as of April to US$7.60 mmbtu (million British thermal units)since oil prices started their downward descent last July. LNG makes up two-thirds of Petronas’ total oil and gas production, and with contract agreements up for renewal, analysts pointed out that earnings would be hit. The average price of spot-LNG in July 2014 was US$13.8MMbtu, and prices rose slightly to US$15.1mmbtu as of Dec 2014. It started adjusting early this year, and as of April, it stands at US$7.9mmbtu. Economists believed that the country would face a current account (CA) deficit in the second quarter if countracts negotiated were not favourable. Citigroup Inc economist Kit Wei Zheng warned that headwinds from lower oil prices, which have not been as severe based on first-quarter gross domestic product (GDP) data, could increase going forward. “The impact of weaker LNG prices on the CA should be maximum in the second quarter, and the CA surplus should recover in the second-half for leading to a full year surplus of 3.2% of GDP,” he said in a report following the release of Bank Negara’s first-quarter GDP data last Friday. In 2014, Petronas produced a total of 1,358 kboe (kilo barrel of oils equivalent) of gas out of a total of 2,226 kboe of oil and gas. Gas made up 61% of Petronas’ total oil and gas production that year. The LNG sales volume that year increased 4% to 30.12 million tonnes from 28.85 tonnes in 2013, driven by higher trading volume and higher sales from the Petronas LNG complex in Bintulu, Sarawak. Not only would that have implications on Petronas earnings, but Petronas’ contributions to government revenue could be impacted. Petronas contribution had dropped to about 22%, from 30%. In 2012 and 2013, when the going was still good and Brent crude stood above US$100 per barrel, Petronas had contributed RM80bil and RM73.4bil respectively to the Government.

http://www.thestar.com.my/Business/Business-News/2015/05/18/LNGs-adverse-effect-on-Petronas-and-Malaysia/?style=biz

M'sian O&G companies should explore consolidation opportunities, says Petronas Monday, 18 May 2015 KUALA LUMPUR: Malaysian oil and gas (O&G) companies must consider exploring consolidation opportunities within the fraternity to increase competitiveness and put the industry in a good stead when the global oil market recovers. Petroliam Nasional Bhd (Petronas) President and Group Chief Executive Officer Datuk Wan Zulkiflee Wan Ariffin said consolidation opportunities were plentiful. "Those with heftier cash and other means to fund consolidation and guided by a clear strategic focus, will be able to beat competitors to the negotiating table for winning deals," he said. The manoeuvres, he added, would also position the companies ahead of the pack when oil prices recover. Wan Zulkiflee said this in his welcoming remarks at the Asia Oil and Gas Conference 2015 here today. http://www.thestar.com.my/Business/Business-News/2015/05/18/Msian-OnG-companies-should-explore-consolidation-opportunities-says-Petronas/?style=biz

6 May 2015: PETRONAS JV group offers US$950 million to native group for Pacific NorthWest LNG project, Petronas completes asset acquisition - 15.5% interest in the Shah Deniz production sharing agreement in the Caspian Sea, a 12.4% stake in Azerbaijan Gas Supply Co and a 15.5% share in the South Caucasus Pipeline Co; PETRONAS carigali pay cut report quickly denied

Petronas-led JV offers aboriginal group US$950m in Canada for project nod (Update) Tuesday, 5 May 2015; KUALA LUMPUR: Pacific NorthWest LNG is offering up to C$1.15bil (US$950mil) over 40 years to an aboriginal community in Canada to approve its natural gas export terminal on Canada’s Pacific Coast. Reports said on Tuesday the joint venture, which is led by Petroliam Nasional Bhd (Petronas) had made the offer to the community, which would be paid over 40 years.

Pacific NorthWest LNG is offering the payments to the Lax Kw’alaams First Nation so it can build the unit on the community’s traditional lands at the port of Prince Rupert in northern British Columbia, the native group said on its website. The reports said the deal also included incentives from the provincial government and gas pipeline developers. According to the native group, the payments are for the life of projects (approximately 40 year to 60 years) using 40 years as an assumption in its summary. http://www.thestar.com.my/Business/Business-News/2015/05/06/Petronas-seeks-Canadian-community-support-for-project/?style=biz

Petronas still in talks with Canadian aboriginal group By Fatin Rasyiqah Mustaza / The Edge Financial Daily | May 6, 2015 : 8:41 AM MYT KUALA LUMPUR: A Petroliam Nasional Bhd (Petronas) led consortium has yet to conclude the long drawn out negotiations with the Lax Kw’alaams First Nation group on the oil company’s plan to build a gasification terminal to export liquefied natural gas (LNG) at the port of Prince Rupert, western Canada. The consortium’s Pacific NorthWest LNG project is required to have the consent of the Lax Kw’alaams to construct a LNG terminal within their territory. The project will liquefy and export natural gas produced by Progress Energy Canada Ltd in which Petronas also holds a controlling stake. Currently, Petronas owns 62% of Pacific NorthWest LNG. Other stakeholders include China Petroleum & Chemical Corp Ltd (15%), Japan Petroleum Exploration Co Ltd (10%), Indian Oil Corp Ltd (10%) and Brunei National Petroleum Company Sdn Bhd (3%). Petronas said an impact benefit agreement offer has been tabled to the Lax Kw’alaams, in addition to offers from both the government of British Columbia and TransCanada Corp.... http://www.theedgemarkets.com/my/article/petronas-still-talks-canadian-aboriginal-group?google_editors_picks=true

Petronas completes asset acquisition Monday, 4 May 2015 - 15.5% interest in the Shah Deniz production sharing agreement in the Caspian Sea, a 12.4% stake in Azerbaijan Gas Supply Co and a 15.5% share in the South Caucasus Pipeline Co; BAKU: Malaysia’s state-owned oil and gas (O&G) giant Petronas has completed its transaction for the acquisition of O&G related assets in Azerbaijan, following a sales and purchase agreement it signed with Norway-based Statoil in October last year.

Petronas’ Azerbaijan country chair Zainal Abidin Zainudin said Petronas completed the acquisition on April 30 and now officially owns a 15.5% interest in the Shah Deniz production sharing agreement in the Caspian Sea, a 12.4% stake in Azerbaijan Gas Supply Co and a 15.5% share in the South Caucasus Pipeline Co. It was reported earlier that Statoil sold its stake in the Shah Deniz project for US$2.25bil (RM8bil). The deal was Petronas’ third largest acquisition, after its US$5.7bil acquisition of Canada’s Progress Energy Resources in 2012 and the US$2.5bil acquisition of Gladstones LNG project in Australia in 2008. Zainal Abidin said the acquisition gives Petronas a strategic presence in a producing field in oil-rich Azerbaijan, where the company is involved in project development totalling around US$38bil.... http://www.thestar.com.my/Business/Business-News/2015/05/04/Petronas-completes-asset-acquisition/?style=biz

*This was soon denied: Petronas Carigali cuts salaries by 20% Posted on 15 April 2015 - 05:39am by Eva Yeong PETALING JAYA: Petronas Carigali Sdn Bhd has asked its staff to take a 20% pay cut in view of the challenging market conditions caused by low global oil prices, a source told SunBiz. According to a memo obtained by SunBiz, Petronas Carigali indicated that a 20% reduction in current salaries would be required effective May 1, 2015. The company said in the memo that it intends to continue investing to sustain production levels despite the low oil price environment affecting its expenditure and projects feasibility. However, it would be challenging to do so at the current cost structure and as part of its cost optimisation efforts, the company has decided to revise salary rates. Petronas Carigali is the exploration and production (E&P) subsidiary of Petroliam Nasional Bhd (Petronas).

UPDATE 1-Petronas not cutting pay or staff, chief executive say (Adds details from Petronas statement) Wed Apr 15, 2015 7:39am EDT (Reuters) - Malaysian state oil firm Petroliam Nasional Bhd (Petronas) on Wednesday denied a media report that said staff at one of its units were asked to take a pay cut due to the plunge in global oil prices. "It is misreporting. There is no salary cut and retrenchment for Petronas staff," Chief Executive Wan Zulkiflee Wan Ariffin told reporters following a shareholders meeting for a Petronas unit. Local newspaper SunBiz earlier reported that Petronas Carigali issued an internal memo asking its staff to take a 20 percent pay cut due to low oil prices.

http://www.reuters.com/article/2015/04/15/malaysia-petronas-idUSL4N0XC42B20150415

21 April 2015: PETRONAS FLNG by 1Q2016, Carigali strives to improve efficiency, Petronas Chemicals gears up for 80%-85% plant utilisation rate; Pengerang terminal added to Platts recognised loadings from Pasir Gudang, Tanjung Langsat, Tanjung Bin and certain floating storage units in nearby waters for its Singapore price assessment process

Petronas FLNG to tap marginal fields by 1Q of 2016 Tuesday, 21 April 2015 By: INTAN FARHANA ZAINUL; KUALA LUMPUR: Petroliam Nasional Bhd (Petronas) expects to complete its ambitious floating liquefied natural gas (FLNG) vessel by the first quarter next year. Petronas vice president and venture director LNG project domestic Datuk Abdullah Karim said on Tuesday the Petronas FLNG 1 (PFLNG) is now 91% completed. "With PFLNG we are able to monetise gas fields which previously were considered too small or stranded," he told reporters at the PFLNG briefing.

He explained that a marginal field for gas would have a reserve of about half a trillion cubic metres.

For the PFLNG1, Abdullah said would be on site, which is in Bintulu, Sarawak (Kanowit field) by March 1 next year. "We are looking about 1.2 million tonnes per annum of LNG production from the PFLNG 1," he said. The PFLNG 1 was designed to operate in shallow waters. The final investment decision for the PFLNG Satu was made on March 27, 2012......... http://www.thestar.com.my/Business/Business-News/2015/04/21/Petronas-FLNG-sails-1Q-next-year/?style=biz

Petronas Carigali strives to improve efficiency to mitigate oil plunge impact Published: 21 April 2015 5:58 PM Petronas Carigali has implemented strategies to improve cost efficiency. – The Malaysian Insider pic, April 21, 2015. Petroliam Nasional Berhad (Petronas)'s upstream arm Petronas Carigali Sdn Bhd has implemented strategic approaches to improve its cost efficiency to mitigate the adverse impact of the plunge in oil prices. Among the initiatives taken is production with minimal cost, leaner operations and drilling, integrated logistics, and better innovation and collaboration, according to a statement issued by the state oil company today. In the same statement, Petronas Carigali president Datuk Mohd Anuar Taib urged Petronas contractors to remain agile, resilient and versatile. Anuar also shared that Petronas Carigali's deliverables were significantly growing in terms of number and complexity.... http://www.themalaysianinsider.com/business/article/petronas-carigali-strives-to-improve-efficiency-to-mitigate-oil-plunge-impa#sthash.4SzG0ueH.dpuf

Petronas Chemicals gears up for 80%-85% plant utilisation rate Tuesday, 21 April 2015

KUALA LUMPUR: Integrated chemicals producer, Petronas Chemicals Group Bhd (PCG) is currently pushing for a higher average plant utilisation rate of between 80 to 85 percent in a bid to drive sales volume. PCG President and Chief Executive Officer Datuk Sazali Hamzah said the company's efforts in this respect are progressing well. "PCG has improved operational excellence, with a plant utilisation rate of 80 per cent last year compared with 78 per cent in 2013, and for 2015 our utilisation rate is expected to rise to 80 to 85 per cent. "And with the latest Sabah Ammonia Urea (SAMUR) plant due for commission next year, PCG's utilisation rate could hit beyond 85 per cent from 2016," he told Bernama on the sidelines of the 3rd Hazards Asia Pacific symposium held here today.......... On the SAMUR project in Sipitang, Sabah and the Refinery and Petrochemical Integrated Development (RAPID) in Pengerang, Johor, Sazali said they are progressing well and on track. "SAMUR is 90 per cent completed and we target to commission it by the first quarter of 2016.

"As for RAPID, as far as I know the project is also progressing as planned," he said.

The world-class SAMUR project aims to produce 740,000 metric tonnes per annum (mtpa) of liquid ammonia and 1.2 mtpa of granulated urea. Meanwhile, RAPID is expected to produce 7.7 mtpa of differentiated and specialty chemicals such as synthetic rubber and high-grade polymers, and its refinery will be capable of producing petrol and diesel that meet Euro 4 and Euro 5 fuel specifications.......... http://www.thestar.com.my/Business/Business-News/2015/04/21/PCG-gears-up-for-80-85-PCT-plant-utilisation-rate/?style=biz

Pengerang gets Platts’ nod Tuesday, 31 March 2015; PETALING JAYA: The Pengerang oil terminal in Johor is expected to receive greater interest following its inclusion into oil agency Platts Singapore’s pricing assessments for middle distillates and gasoline. Industry players said the inclusion of the Pengerang oil terminal was expected to offer traders more flexibility in loading cargo and improve market liquidity. “This will help efforts to make Johor the region’s oil and gas trading hub by providing traders accurate and timely information on the prices of oil products,” an analyst said. The Pengerang terminal, majority owned by the 51%-49% joint venture between Dialog Group Bhd and Dutch oil and chemicals storage company Vopak, started operations last year.