Issues for Successful Deployments

By Abigael Eminza and Claudia Nyon

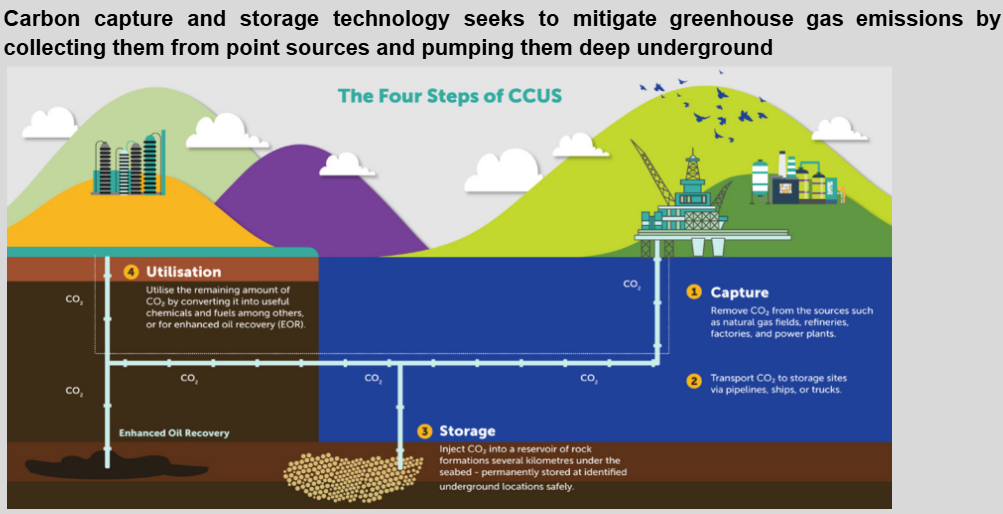

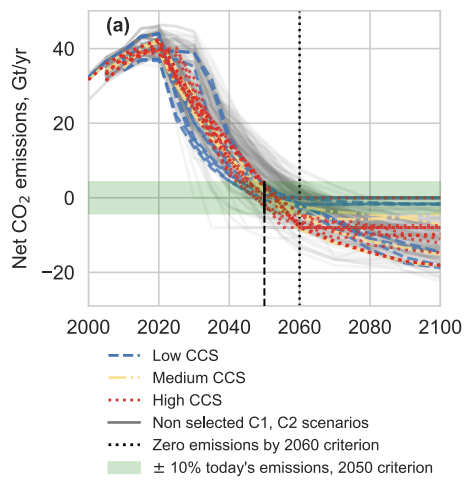

Successful deployment of Carbon Capture, Utilisation and Storage (CCUS) depends not only on technology but also on coherent policy, law, and financial frameworks. Countries like Norway demonstrate that a strong business case, reinforced by carbon pricing and regulatory certainty, is essential to make CCUS cost-competitive and attractive for private investment. At the international level, instruments such as the London Protocol govern cross-border CO2 transport, though gaps remain, particularly in ASEAN and other emerging markets. Fiscal measures, including subsidies, tax incentives, and revenue guarantees, can help overcome the reluctance of businesses to be first movers in new CCS hubs. This section examines the legal, financial, and policy levers required to scale CCUS while highlighting both the potential benefits and inherent challenges.

National Policy and Laws

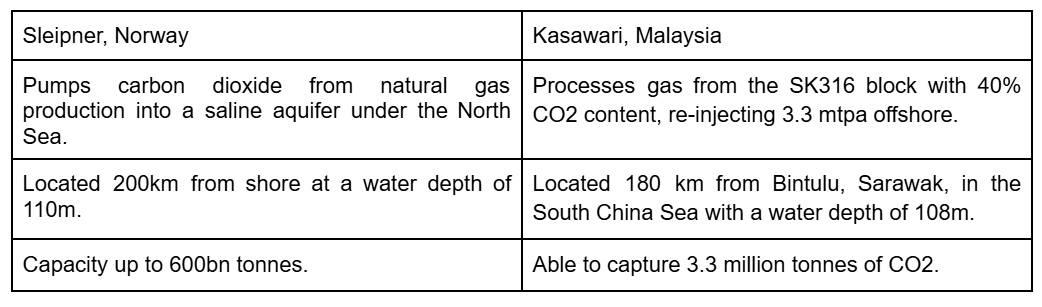

Robust legal frameworks underpin successful CCUS deployment, ensuring that technology can translate into real-world emission reductions. Norway demonstrates how a strong policy environment, anchored by carbon pricing, can make CCUS commercially viable. The Sleipner project, often cited as the world’s first large-scale CCS facility, was made possible by the Norwegian carbon tax on offshore oil and gas, which created a compelling business case for investment (Global CCS Institute). This shows how fiscal levers, such as targeted taxes, incentives, or revenue guarantees, can help overcome market reluctance, especially where pure economic returns are uncertain.

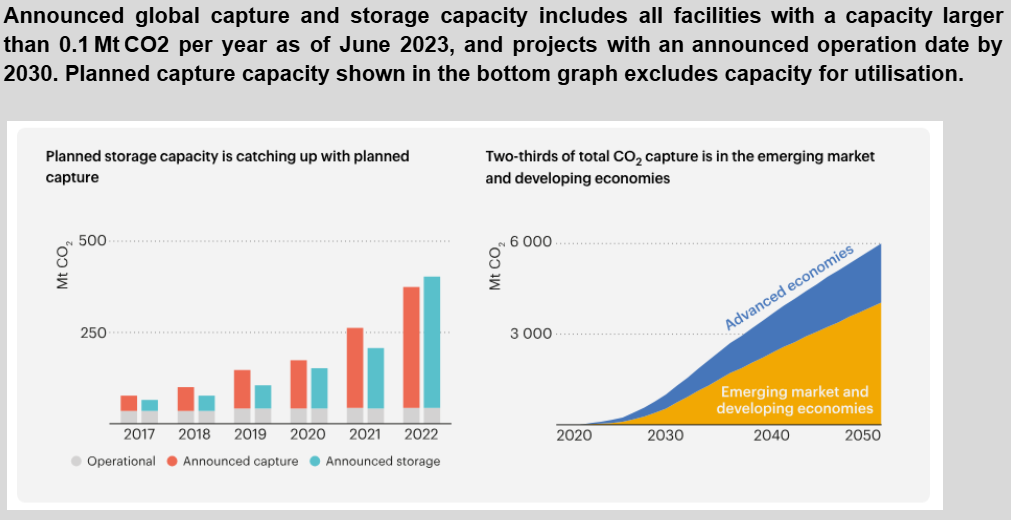

Globally, a persistent challenge lies in the mismatch between planned capture capacity and available storage. Without regulatory certainty, private actors are often reluctant to invest, highlighting the importance of laws that guarantee long-term access and clearly define liability arrangements for CO2 storage (Global CCS Institute). International frameworks, such as the London Protocol, guide cross-border CO2 transport, but limited ratification, particularly in ASEAN and other emerging markets, continues to restrict regional deployment. Bilateral or multilateral agreements may serve as interim solutions, yet broader harmonization is needed to reduce legal uncertainty and enable large-scale projects.

Some countries are beginning to experiment with domestic CCUS legislation. For example, Sarawak enacted a law in 2024 to promote CCUS projects, representing one of the first attempts in ASEAN to integrate CCUS into national energy transition pathways (Laws of Sarawak, 2024). Such legislation must be aligned with international commitments, including the Paris Agreement, to ensure consistency and attract private investment. In addition, developing robust regional standards for measurement, reporting, and verification (MRV) is essential to provide credible, transparent assessments of greenhouse gas reductions (Havercroft et al., 2024; World Bank Group, 2022).

Effective CCUS regulation also requires clearly defined processes and obligations throughout the entire project lifecycle. From planning and exploration to operation, closure, and post-closure, operators must obtain authorisations at key milestones, ensuring accountability and regulatory oversight at every stage (Havercroft et al., 2024). Establishing such frameworks helps create confidence for investors, protects the environment, and provides a predictable pathway for scaling CCUS while balancing technical, financial, and legal considerations.

Hefty CCUS investment is needed globally

Global CCUS deployment requires substantial investment. US$196 billion will be needed through 2034 to support planned CCUS projects worldwide (Wood Mackenzie, 2024).To mobilise this level of funding, a combination of financial and policy mechanisms is critical. Key instruments that can attract private investment and reduce early-stage risks include:

Fiscal incentives: This would allow for private finance as “The only means by which a positive return on investment in CCS is achieved is when the service provided by CCS (CO2 emissions abatement) is monetised” (Global CCS Institute, 2021). Incentives, such as subsidies, tax credits, and price support mechanisms, can bridge the gap between technical feasibility and commercial viability (McKinsey & Company, 2022).

Tax measures: Targeted tax policies, exemplified by the Sleipner project in Norway, demonstrate how carbon taxation can create a robust business case for investment in CCUS infrastructure, effectively reducing financial risk and encouraging uptake (Global CCS Institute, 2021).

Revenue guarantees: Initial investment in CCS hubs and clusters is hindered by first-mover risk. Businesses prefer mature networks where financial returns are more predictable (Williams et al., 2024). Guarantees of revenue or offtake agreements during early project stages can lower this barrier, enabling governments to play a pivotal role in catalysing private sector participation.

Cross-border issues, London Protocol

Several international treaties and protocols provide a legal and regulatory framework relevant to CCUS, particularly for offshore storage and cross-border operations. The London Protocol (2009 amendment) and its predecessor, the London Convention (1972), govern the sub-seabed injection and transboundary transport of CO2 while protecting the marine environment. UNCLOS (1982) establishes general obligations for offshore environmental protection, and the Convention on Biological Diversity (1992) ensures that CCUS activities avoid harming marine ecosystems. The Paris Agreement (2015) sets climate targets that drive CCUS deployment within national mitigation strategies, while IMO regulations oversee the safe maritime transport of captured CO2. Collectively, these instruments provide a patchwork of environmental, safety, and climate obligations, highlighting the need for coordination between international law and national regulations to enable large-scale, legally compliant CCUS projects.

More on the Convention on the Prevention of Marine Pollution by Dumping of Wastes and Other Matter 1972 (or the London Protocol).

Originally designed for waste management, the London Protocol entered into force on 24 March 2006 and had 54 contracting parties as of September 2023. Article 6 prohibits contracting parties from allowing the export of wastes into the sea, which has been interpreted to include carbon and its cross-border transfer for sub-seabed storage. In response, the Protocol was amended in 2009 to allow cross-border transportation of CO2 for sub-seabed storage, although this amendment has not yet been ratified by two-thirds of contracting parties. It has been suggested that contracting parties could enable transboundary CO2 export through separate treaties (International Energy Agency, 2011).

Despite these legal adjustments, the Protocol provides only a partial framework for CCUS. It establishes environmental safeguards and clarifies responsibilities, which reduces regulatory uncertainty and gives investors greater confidence to develop large-scale CCS hubs. However, its effectiveness is constrained by incomplete ratification, limited adoption in regions such as ASEAN, and its original focus on waste management, leaving gaps in areas like long-term monitoring, liability, and post-closure obligations. To fully enable deployment, countries often need additional national regulations or bilateral agreements, meaning the Protocol serves as a foundational framework rather than a complete solution for international CCUS expansion (International Energy Agency, 2011).

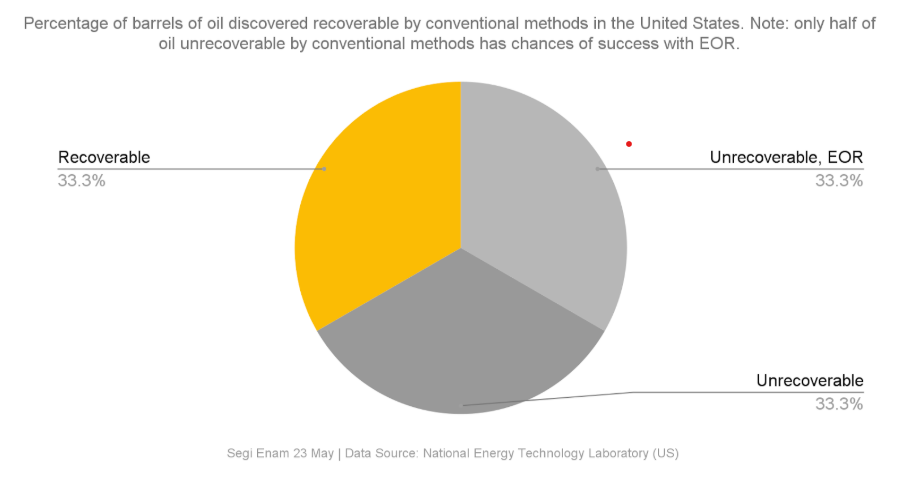

Opportunities and limits of EOR and retrofitting

Enhanced Oil Recovery (EOR) can potentially legitimize continued oil consumption and lower prices. Policy support, such as financial incentives for CO2 stored, should be strictly limited to cases where:

The combination of the CO2 source and carbon intensity of injection delivers zero or negative net emissions.

Captured CO2 is used productively, while EOR using mined CO2 is never supported and ideally discouraged.

Overall, oil demand is constrained by ambitious decarbonisation policies applied across end-use sectors.

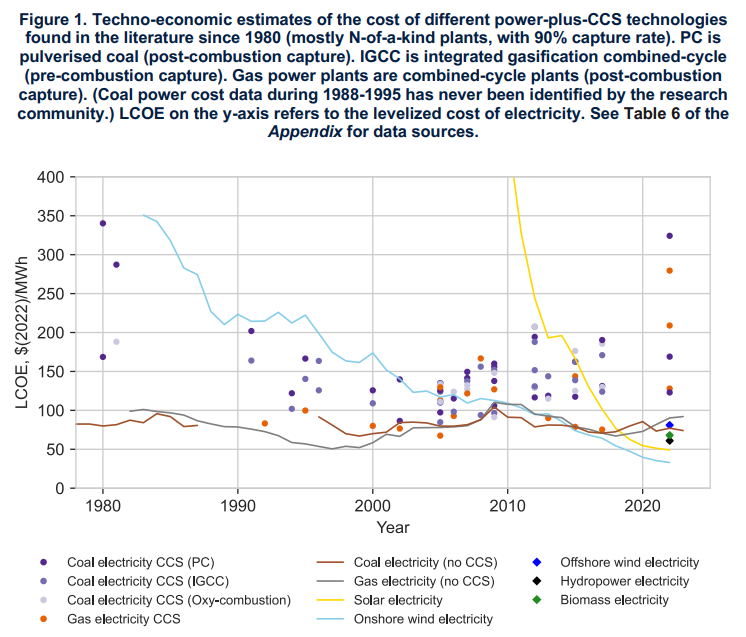

New technologies and improvements are under development for post-combustion, pre-combustion, and oxy-fuel combustion capture systems. It remains unclear which CO2 capture technologies will be the most effective in delivering cost reductions and performance improvements, as several are still in the early stages of development and demonstration (IEA, 2020).

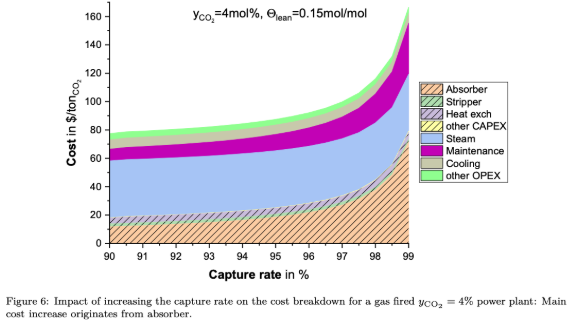

Retrofitting existing coal-fired power plants is expensive, technically challenging, and comes with a significant energy ‘penalty’, the extra energy required to power capture operations. Economic sustainability of post-combustion retrofits should be compared on a portfolio basis to CCS on new-build plants, where energy efficiency can be optimised and sequestration sites strategically selected (Hardisty et al., 2011).

CO2 currently lacks sufficient intrinsic market value to make projects economically viable without subsidies. Globally, carbon is largely treated as a waste product with limited commercial value or cascading uses (McLaughlin et al.,2023). National carbon pricing is often absent or insufficient, and public intervention is needed to treat carbon removal as a public good. Effective policies must combine strong government funding, financial incentives, and regulatory frameworks to drive innovation, scale-up, and cost reductions.

Promising developments are emerging in voluntary carbon markets. In 2022, these markets began differentiating by activity type, with carbon removal projects commanding the highest value (Ulucak et al., 2019). The average carbon credit price for carbon removal (~$20/tCO₂) was more than twice that for nature-based removal (~$10/tCO₂) and about four times that for renewable energy offsets (~$5/tCO₂) (McLaughlin et al.,2023).

Key findings: Scaling CCUS requires an integrated approach combining technology, policy, and finance. Countries with supportive regulatory frameworks and financial incentives, such as Norway, demonstrate higher feasibility and investor confidence. However, economic viability is constrained by high retrofitting costs, low CO₂ market value, and technological uncertainty. To achieve meaningful climate impact, governments must provide robust incentives, clear legal frameworks, and credible carbon pricing to enable CCUS projects to move beyond demonstration to large-scale deployment.

In this series:

Part 1: Climate Mitigation and the Price of CCUS

Part 2: Case Studies

Part 3: Malaysia’s Big Ambitions

Part 4: Issues for Successful Deployments

Reach us at khorreports[at]gmail.com